PenFed Credit Union survey reveals 3 biggest influences on new home purchase

First time buyers are set to be active in the coming 12 months according to a new survey.

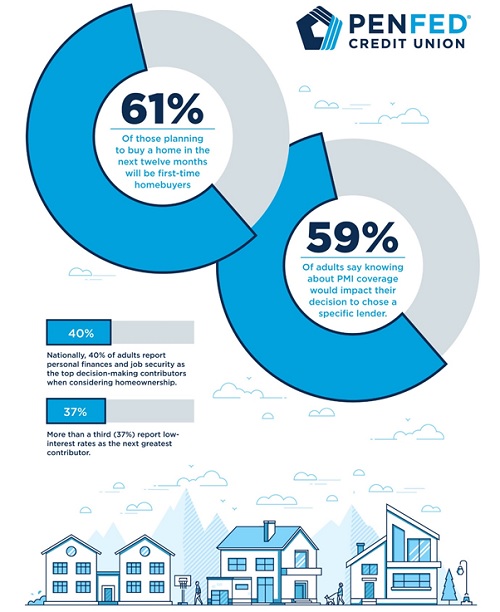

PenFed Credit Union’s Mortgage Survey finds that 61% of those who said they intend to buy are first timers.

The nationwide poll also discovered that 40% of respondents said that their personal finances or job stability is the most important influence over their buying decision, beating interest rates (37%).

Among those that are not intending to buy in the year ahead, being happy in their current living situation (42%) or personal finances (19%) are they likely reasons rather than external factors such as the state of the housing market (6%) or state of the economy (7%).

But there are challenges for many respondents, with 30% saying that being unable to afford a down payment in the city or town where they currently live is the primary reason they are not looking to buy a home in that area in the next 12 months.

Financing their home purchase

On financing, 76% intend to use a bank or credit union for their purchase and 73% report that down payment requirements are important when deciding on a specific lender.

More than half (59%) of adults say knowing about Private Mortgage Insurance (PMI) coverage would impact their decision to choose a specific lender.