Higher rates and cautious lending standards make borrowing more difficult for buyers

Mortgage applications took a sharp hit last week as rising interest rates continue to weigh on borrowers.

The Mortgage Bankers Association (MBA) reported a 17% week-over-week decline in applications for the week ending October 11. The steady climb in mortgage rates is slowing down mortgage activity across the board, making it tougher for both buyers and homeowners seeking to refinance.

The 30-year fixed-rate mortgage, the go-to option for most borrowers, saw rates increase to 6.52% from 6.36% the week before, marking the third straight week of increases and the highest level since August.

“The recent uptick in rates has put a damper on applications,” MBA deputy chief economist Joel Kan.

Refinance activity has taken the biggest hit, with the Refinance Index plummeting by 26%. This drop brings refinance applications to their lowest point since August, contributing to a reduced share of refinances – now making up just 46.5% of total mortgage applications, down from 52.4% the previous week. Both conventional and government refinance programs saw notable declines.

“Refinance applications fell 26% to their lowest level since August, with comparable drops in both conventional and government refinances,” Kan explained. “This pushed the refinance share of applications back below 50% for the first time in over a month. Furthermore, purchase applications also decreased but notably remained 7% higher than a year ago.”

Purchase applications also fell, declining by 7% compared to the previous week. However, despite the decline, purchase applications remain 7% higher than they were a year ago, suggesting that housing demand is still holding strong, even in the face of rising borrowing costs.

One of the reasons for the resilience in purchase applications, especially among first-time homebuyers, is the gradual improvement in housing inventory.

Read next: Mortgage market poised for growth as buyer sentiment improves

“Demand is holding up to an extent for prospective first-time buyers,” Kan noted. “FHA purchase applications were little changed despite the increase in rates, as some first-time homebuyers remain in the market because of improving housing inventory conditions.”

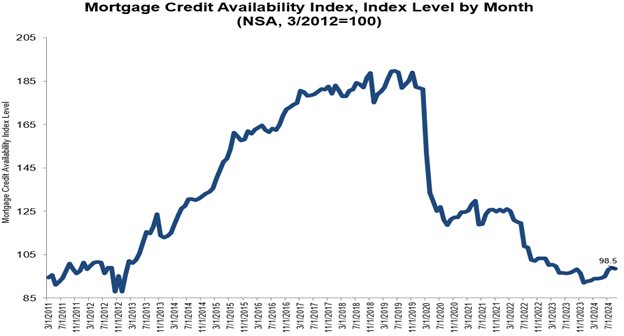

In another sign of a tighter mortgage landscape, credit availability also decreased. MBA’s Mortgage Credit Availability Index (MCAI), which tracks lending standards, fell by 0.5% in September.

This indicates that lenders are becoming more cautious about approving loans. The Conventional MCAI dropped 1.7%, while the Jumbo MCAI, which covers larger loans, saw an even steeper decline of 2.6%. Meanwhile, the Government MCAI rose by 0.8%, driven by an increase in VA streamline refinance offerings.

“Mortgage credit availability tightened slightly in September as lenders remained cautious in this uncertain economic environment,” Kan said. “There was a decline in loan programs for cash-out refinances, jumbo and non-QM loans, including loans that require less than full documentation. Most component indexes decreased over the month, but the government index increased, driven by more offerings of VA streamline refinances.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.