CoreLogic HPI Report shows second month of stabilization in June

Home price acceleration has stabilized for a second consecutive month but there is likely to be an uptick over the coming year.

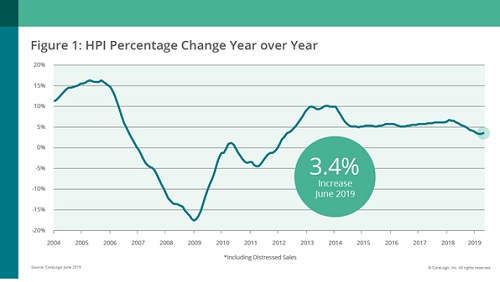

The CoreLogic Home Price Index (HPI) Report based on June 2019 data shows that prices were up 3.4% year-over-year and 0.4% month-over-month (after revised May figures).

But if first-time homebuyers are hoping for an easier ride, they may be disappointed with CoreLogic’s HPI Forecast estimating a 5.2% increase in prices through June 2020.

“Tepid home sales have caused home prices to rise at the slowest pace for the first half of a year since 2011,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Price growth continues to be faster for lower-priced homes, as first-time buyers and investors are both actively seeking entry-level homes. With incomes up and current mortgage rates about 0.8 percentage points below what they were one year ago, home sales should have a better sales pace in the second half of 2019 than a year earlier, leading to a quickening in price growth over the next year.”

Market indicators

CoreLogic Market Condition Indicators reveal that, among the 100 largest 100 largest metropolitan areas based on housing stock, 38% have an overvalued housing market as of June 2019, 24% were undervalued, and 38% were at value.

Among the top 50 markets based on housing stock, 42% were overvalued, 16% were undervalued and 42% were at value.

The MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

Affordable housing options remain a challenge for homebuyers, especially first-time buyers in the millennial cohort.

“Millennial homebuyers are no longer a trend on the industry horizon. In fact, they are the new, first-time homebuyers of today. However, only about half of recent millennial buyers were satisfied with the number of options of available homes in their market or price range,” said Frank Martell, president and CEO of CoreLogic. “Affordable housing continues to be a growing issue. A deeper look at the data shows that 43% of those surveyed indicated they couldn’t afford to buy a new home or are concerned they won’t be able to.”