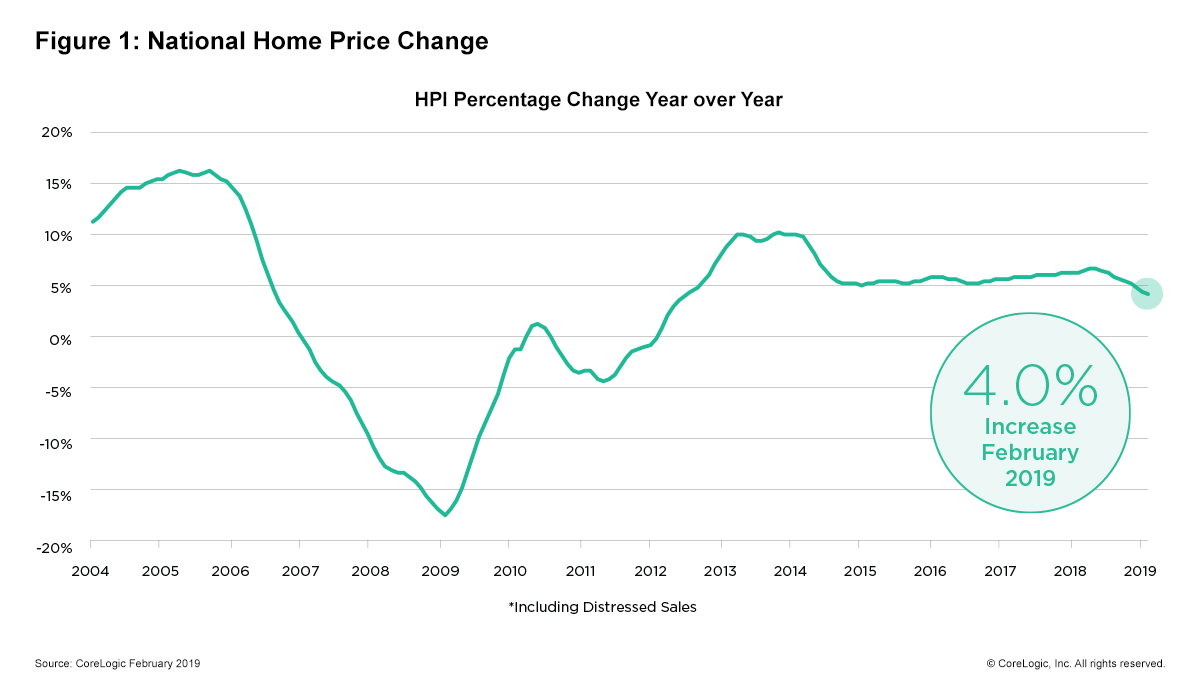

February price growth was 4% but low mortgage rates should boost the market

Home prices nationally gained 0.7% month-over-month in February and 4.0% year-over-year.

CoreLogic’s Home Price Index shows that home price appreciation is trending slower in 2019 than during the same period of 2018, but there are larger gains ahead.

The firm’s HPI Forecast calls for the initial moderation in prices for this year to be followed by larger gains with an annual rise of 4.7% for the year as a whole.

“During the first two months of the year, home-price growth continued to decelerate,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This is the opposite of what we saw the last two years when price growth accelerated early. With the Federal Reserve’s announcement to keep short-term interest rates where they are for the rest of the year, we expect mortgage rates to remain low and be a boost for the spring buying season. A strong buying season could lead to a pickup in home-price growth later this year.”

Many markets remain overvalued

CoreLogic says that among the top 100 largest US metros (based on housing stock), 35% have an overvalued housing market as of February 2019, while 27% were undervalued and 38% were at value.

And among the 50 largest, the share of overvalued markets is even greater.

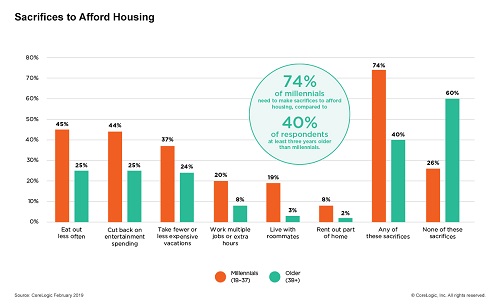

“About 40% of the top 50 largest metropolitan areas in the country are now categorized as overvalued and we expect that percentage to grow over the remainder of 2019. The cost of either buying or renting in expensive markets puts a significant strain on most consumers,” said Frank Martell, president and CEO of CoreLogic. “Our research tells us that about 74% of millennials, the single largest cohort of homebuyers, now report having to cut back on other categories of spending to afford their housing costs.”