"Shortage of for-sale homes is likely to keep price declines modest"

U.S. home prices continued to depreciate in January, down for the ninth straight month and the lowest recorded since June 2020.

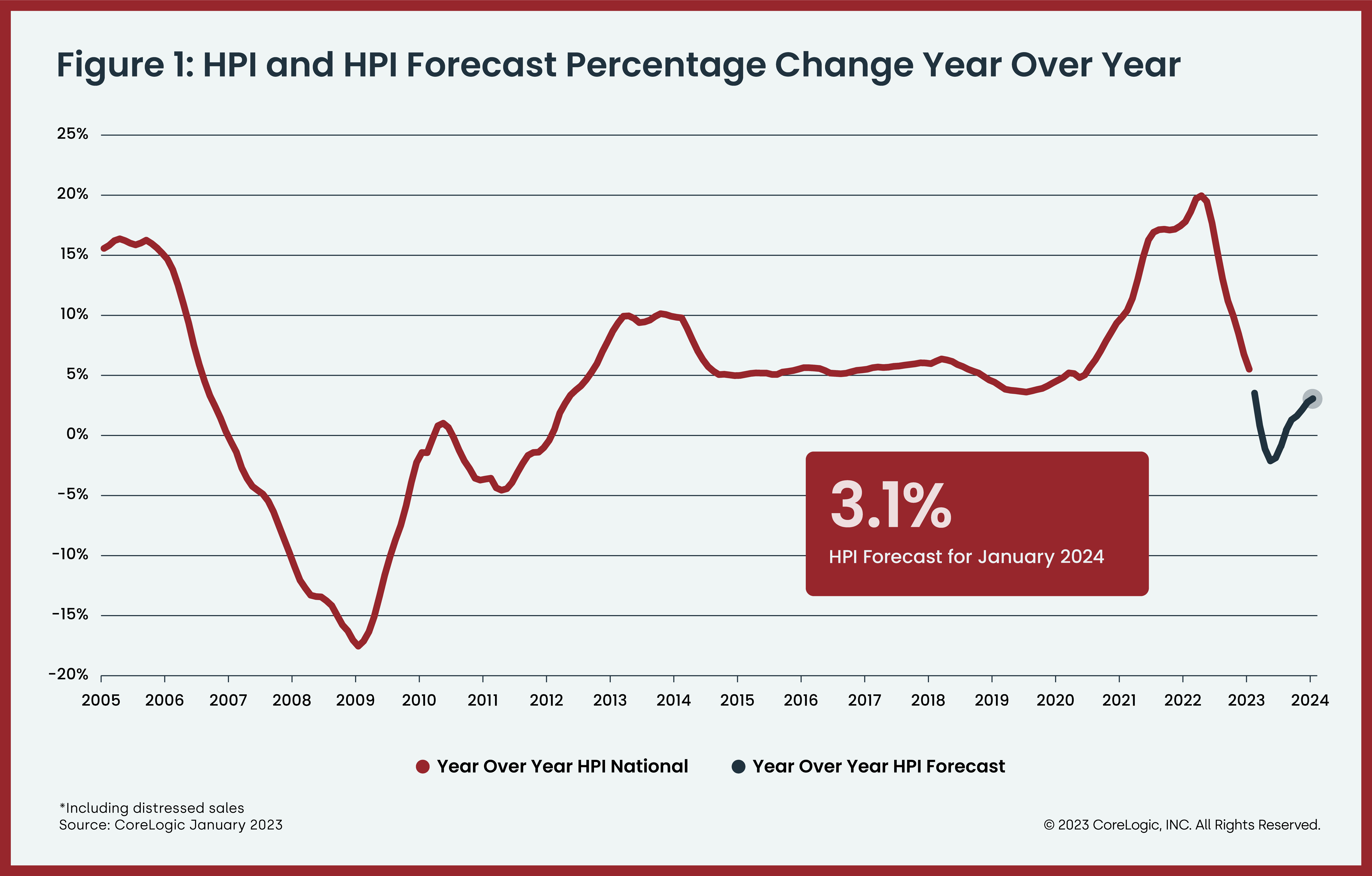

The CoreLogic Home Price Index (HPI) showed that prices posted a 5.5% annual gain in January. On a month-over-month basis, home prices dipped by 0.2% compared to December.

"While 2023 kicked off on a more optimistic note for the U.S. housing market, recent mortgage rate volatility highlights how much uncertainty remains," said CoreLogic chief economist Selma Hepp.

"Home price depreciation and strong income growth are expected to boost affordability, which is particularly important for first-time buyers. This group has accounted for a higher share of mortgage applications since last summer, as first-time buyers don't need to surrender an extremely low mortgage rate like current homeowners."

The year-over-year appreciation of attached properties (6.5%) was 1.3 percentage points higher than that of detached properties (5.2%).

Of the 20 largest metro areas, Miami saw the highest gain of 17.3%, while Tampa, Fla., continued to rank second at 11.7%. Florida and Maine reported the highest annual home price gains, 13.4% and 11.5%, respectively. South Carolina came in third with a 10.7% year-over-year increase. Three states and one district registered year-over-year price declines: Idaho (-2.3%), Washington (-2.2%), Montana (-0.6%) and Washington, D.C. (-0.1%).

In its HPI forecast, CoreLogic expects home price gains to decelerate to a 3.1% pace by January 2024.

"The continued shortage of for-sale homes is likely to keep price declines modest, which are projected to top out at 3% peak to trough," Hepp said.

Want to make your inbox flourish with mortgage-focused news content? Get exclusive interviews, breaking news, industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.