And the pace is set to increase if conditions remain

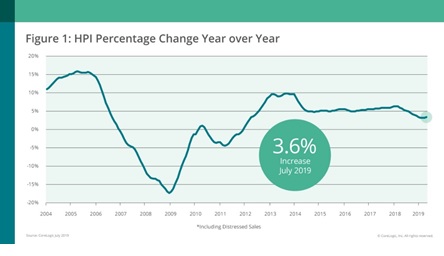

US national home prices picked up pace in July with a 3.6% year-over-year increase.

CoreLogic’s Home Price Index reveals a 0.5% gain from a revised June reading; the amount predicted by the firm’s HPI Forecast, a projection of home prices calculated using the CoreLogic HPI and other economic variables.

“Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income,” said Dr. Frank Nothaft, chief economist at CoreLogic. “With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.”

Meanwhile, the HPI Forecast for the year to July 2020 calls for a 5.4% increase while the forecast for July to August 2019 is a 0.4% increase.

Most markets at correct values

Among the 100 largest US metros by housing stock, CoreLogic’s Market Condition Indicators analysis shows that 37% were considered overvalued in July, 23% were undervalued, and 40% were at value. For the 50 largest metros, 40% were overvalued, 16% undervalued, and 44% were at value.

The MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

“A growing number of millennials are expressing an interest in buying homes, reinforcing the theory that this cohort is continuing to engage within the housing market,” said Frank Martell, president and CEO of CoreLogic. “But, with so few homes available for sale, the imbalance has created an affordability crisis that is getting worse every day. Demand exceeds supply and we’re unsure of when the two will balance out.”