Data reveals mixed signals: monthly dips vs. solid yearly increases

US home prices fell for the second month in a row. Despite the recent dips, a look at the year-over-year data tells a story of resilience and growth in home values across the nation.

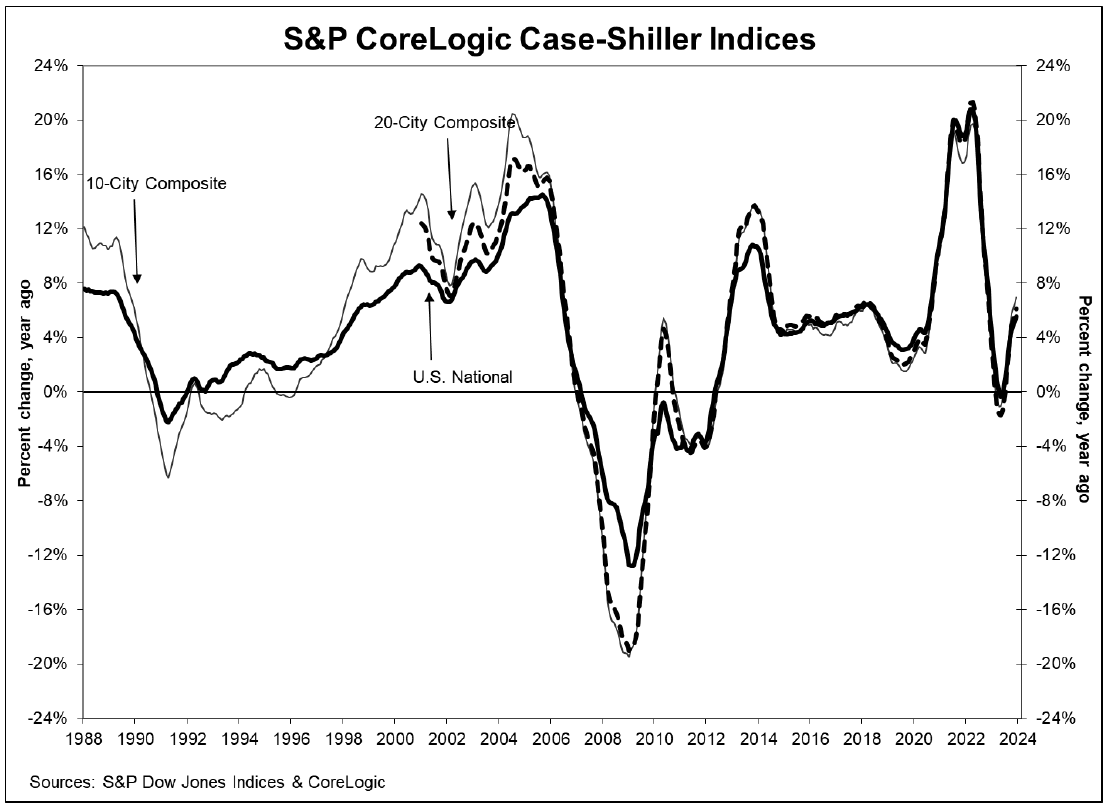

The S&P CoreLogic Case-Shiller National Home Price NSA Index reported a 0.4% drop in December, with the 20-City Composite and 10-City Composite posting 0.3% and 0.2% month-over-month decreases, respectively.

The year-over-year data, however, showed a silver lining, up 5.5% from 5% in November. The 10-City and 20-City Composites also recorded gains, with year-over-year increases of 7% and 6.1%, respectively.

CoreLogic chief economist Selma Hepp pointed out the conflicting signals in the housing market: “The stress of high mortgage rates at the end of 2023 continued to depress prices, which were down 0.4% compared to November - the second month of lower prices,” she said in the report

San Diego led the charge with an 8.8% jump, the highest among the 20 cities, closely followed by Los Angeles and Detroit, each with an 8.3% boost. Meanwhile, Portland saw a modest 0.3% increase, landing it at the bottom of the growth chart for the month.

“2023 US housing gains haven’t followed such a synchronous pattern since the COVID housing boom,” said Brian Luke, head of commodities, real and digital assets at S&P Dow Jones Indices. “The term ‘a rising tide lifts all boats’ seems appropriate given broad-based performance in the US housing sector.”

Read next: How challenging is margin compression for loan officers?

Although the initial spike in home prices during the pandemic might have temporarily accelerated homeownership, the consistent growth over the past two years points to a significant, secular shift in homeownership.

“In the short term, meanwhile, we should be able to measure the impact of higher mortgage rates on home prices,” he added. “Increased financing costs appeared to precipitate home price declines in the fourth quarter, as 15 markets saw lower values compared to September.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.