The gap between their valuations and those of professional appraisers has narrowed again

The gap between the value homeowners put on their refinance mortgage applications and the value assessed by professional appraisers has narrowed for the third straight month.

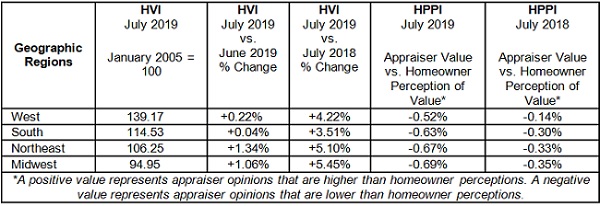

The gap was 0.63% in July according to the Quicken Loans’ National Home Price Perceptions Index (HPPI). The analysis of 27 metros found that the gap between the two valuations was less than 1% in 20 metros, and only 2 saw a gap of larger than 1.5%.

"As expected, with mortgage rates at three-year lows and the refinance share of mortgage activity continuing to hover above 50%, homeowners are increasingly aware of the true value of their home, said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. "Prices continue to increase in most areas but the rapid growth of years past has moderated giving homeowners a better sense of their home's market value."

Home values increased

The lender’s Home Value Index showed a 0.6% month-over-month increase in home values, based solely on Quicken Loan’s own data. The year-over-year increase matched that of June at 4.78%.

"The fact that July had the highest Quicken Loans Home Value Index since January 2007, has to be encouraging, especially to those who were deeply underwater during the worst of the recession," Banfield said. "The 1% drop in interest rates so far this year will help address affordability but the strength of the economy and a lack of new homes being built will also play a big role."