It's a positive trend amid tougher times

There was hopeful news on the mortgage loan front this week: Independent mortgage banks and mortgage subsidiaries of chartered banks reported a smaller net loss on originated loans quarter-over-quarter.

The number of profitable companies also increased during that time period.

Lenders saw a pre-tax net loss of $534 on each loan they originated in the second quarter, an improvement from the reported loss of $1,972 per loan in the first quarter of this year. The findings were outlined in the Mortgage Bankers Association’s (MBA) newly released Quarterly Mortgage Bankers Performance Report.

“After 11 consecutive quarters of increases, origination costs declined by over $2,000 per loan during the second quarter of 2023,” Marina Walsh, MBA’s vice president of Industry Analysis, said. “Volume picked up during the spring homebuying season and additional personnel were shed. However, the substantial cost savings per loan was not enough to put the average net production income in the black.”

Companies eke out profits despite tough times

Walsh added: “There were signs of improvement in the second quarter of 2023. Production losses were less severe than the previous two quarters and net servicing financial income was strong. Additionally, the majority of mortgage companies in our survey managed to squeeze out an overall profit during one of the toughest times for the mortgage industry.”

Including both the production and servicing business lines, 58% of companies were profitable last quarter, an improvement from 32% in the first quarter of 2023 and 25% in the fourth quarter of 2022.

Gains are an expansion of a recent trend

The results are part of a promising trend. The same sampling of lenders reported a net loss of $1,972 on each loan they originated in the first quarter of 2023 – an improvement from the reported loss of $2,812 per loan in the fourth quarter of 2022, MBA researchers found.

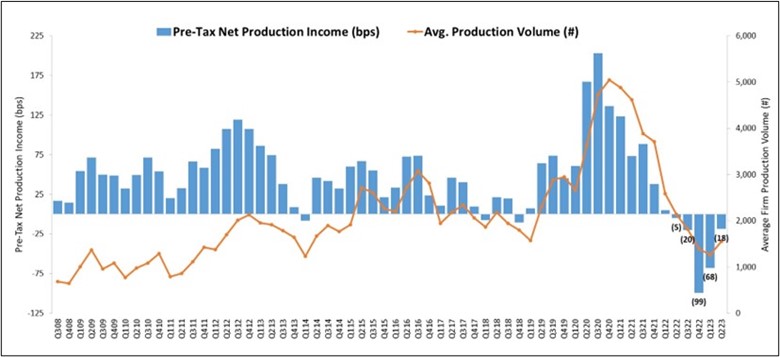

“A net production loss of 68 basis points in the first quarter of the year is an improvement over the record 99-basis-point loss reported in the fourth quarter of 2022,” Walsh said at the time. “Conditions continue to be challenging for the industry, with now four consecutive quarters of production losses and nine consecutive quarters of volume declines.”

Walsh added: “One silver lining from the first quarter is that production revenues improved by 40 basis points. However, costs continued to escalate with the further drop in volume and reached more than $13,000 per loan despite substantial personnel reductions.”

Among the key findings of the most recent report are:

- The average pre-tax production loss was 18 basis points (bps) in the second quarter of 2023, compared to an average net production loss of 68 bps in the first quarter of 2023, and down from a loss of 5 basis points one year ago. The average quarterly pre-tax production profit, from the third quarter of 2008 to the most recent quarter, is 47 basis points.

- The average production volume was $502 million per company in the second quarter, up from $398 million per company in the first quarter. The volume by count per company averaged 1,553 loans in the second quarter, up from 1,264 loans in the first quarter.

- Total production revenue (fee income, net secondary marketing income and warehouse spread) decreased to 328 bps in the second quarter, down from 358 bps in the first quarter. On a per-loan basis, production revenues decreased to $10,510 per loan in the second quarter, down from $11,199 per loan in the first quarter.

- The purchase share of total originations, by dollar volume, increased to a study high of 89% in the second quarter. For the mortgage industry as a whole, MBA estimates the purchase share was at 80% in the second quarter of 2023.