Mortgage credit availability decreased as supply tightened for several loan types and programs

The availability of mortgage credit decreased in February as lenders tightened lending restrictions.

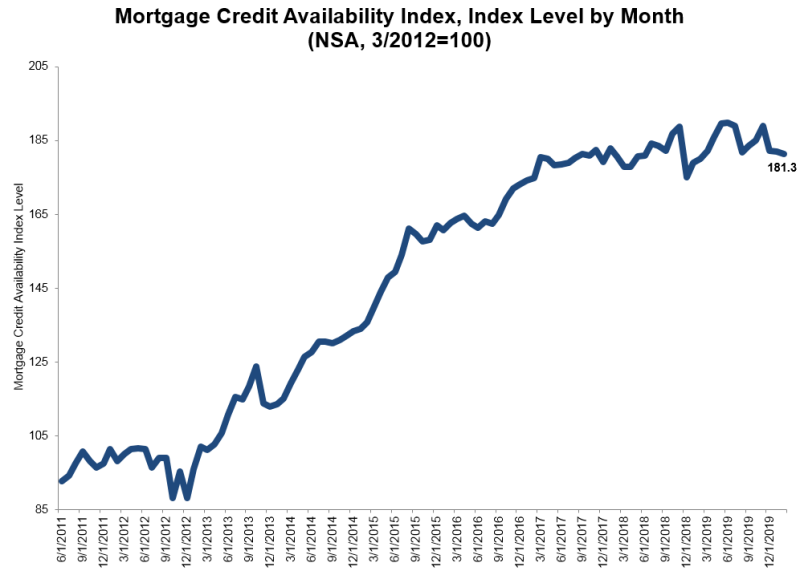

The Mortgage Bankers Association says that its Mortgage Credit Availability Index was down 0.3% to 181.3 last month with the Conventional MCAI down 1.2% while the Government MCAI increased by 0.7%.

The components of the Conventional MCA were both lower: the Jumbo MCAI decreased by 1.0% and the Conforming MCAI fell by 1.6%.

"Mortgage credit supply decreased in February, as both conforming and jumbo segments of the market saw a decline," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "There were also reductions in ARM program offerings, as well as in low credit score programs offered by investors."

Kan added that the activity seen in February was the calm before the storm.

Mortgage rates dropped steeply in the last week of February and a large surge of refinance activity followed. Investors may adjust their future mortgage credit offerings based on the sudden upswing in demand."

The MCAI was benchmarked to 100 in March 2012 and is based on an analysis of data from Ellie Mae's AllRegs Market Clarity business information tool.