The share of FHA applications steadily increases while refinancing resumes its downward arc

Mortgage applications grew by another half percentage point last week, the latest data from the Mortgage Bankers Association reveals.

Since 1990, the MBA has published its weekly mortgage applications survey, covering more than 75% of all US retail residential mortgage applications and collecting data from mortgage bankers, commercial banks, and thrifts.

The mortgage applications survey for the week ending in June 16 revealed that the mortgage loan application volume – or the MBA’s ‘market composite index’ – increased by 0.5% from last week after seasonal adjustments. The raw, unadjusted numbers showed a 1% dip compared with the previous week.

Just the week before, the market composite index registered a 7.2% spike on a seasonally adjusted basis driven by lower mortgage rates.

For the week ending June 16, the survey’s refinance index showed a 2% decrease from a week earlier, while the seasonally adjusted purchase index increased by the same proportion from the previous week. The purchase index decreased by 10 basis points on an unadjusted basis.

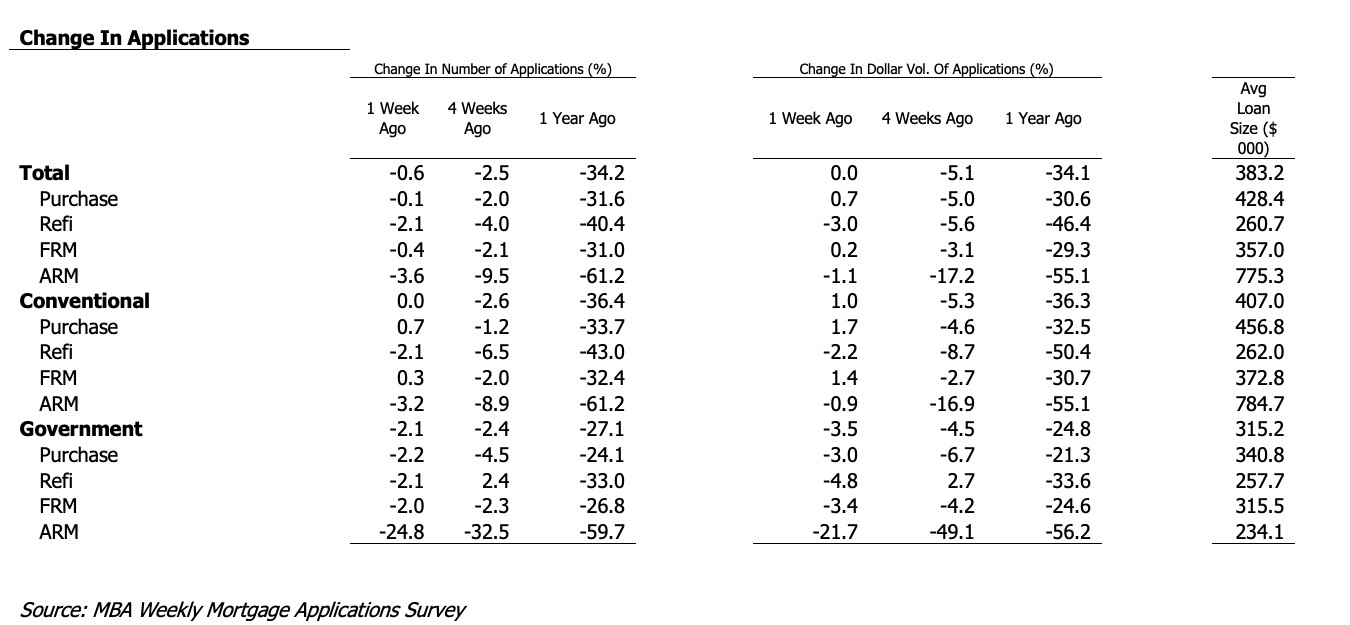

Also studying the total volume of mortgage applications for the week ending on June 16, the MBA found:

- The share of refinance applications dropped by 40 basis points to 26.9%, following the general downward trend of refinance activity after the previous week’s temporary spike

- The share of adjustable-rate mortgage applications likewise decreased week-on-week to 6.3% of total applications

- Federal Housing Administration-backed (FHA) applications made up a bigger share of the total applications activity for the week, rising by 30 basis points to 13.3%

- Veterans Administration (VA) and Department of Agriculture (USDA) applications each cut a thinner slice of the pie, with VA applications decreasing to 11.9% from the previous week’s 12.6%, and USDA applications slipping from 0.5% to 0.4% of all mortgage applications for the week ending in June 16.

“First-time homebuyers account for a large share of FHA purchase loans, and this increase is a sign that while buyer interest is there, activity continues to be constrained by low levels of affordable inventory,” said MBA vice president and deputy chief economist Joel Kan. “Refinance applications continued their decline after the previous week’s increase, with the refinance share of applications just below 27%.”

The average contract interest rate for 30-year, fixed-rate mortgages with conforming loan balances ($726,200 or less) experienced a four-basis-point drop to 6.73%, while the average contract interest rate for the same type of mortgage with a jumbo loan balance, i.e. over $726,000, increased by one basis point to 6.8%.

Points slid from 0.65 to 0.64 for 80% loan-to-value ratio (LTV) loans on 30-year fixed rates. The effective rate decreased from last week.

For 30-year, fixed-rate mortgages backed by the FHA, the average contract interest rate increased by four basis points to 6.74%.

A 15-year, fixed-rate mortgage saw an average contract interest rate of 6.26% last week, increasing by one basis point from the week prior. Points dropped from 1.05 to 0.71 for 80% LTV loans. The effective rate also decreased on a weekly basis.

“The 30-year fixed mortgage rate declined for the third consecutive week to 6.73%, while other mortgage rates saw mixed results,” Kan said. “Purchase applications increased, driven by 2% gain in conventional purchase applications and a 3% increase in FHA purchase activity.”

Kan also noted that the last time jumbo rates exceeded confirming ones was in December 2021.

“Tighter liquidity conditions have prompted jumbo lenders to pull back, increasing rates in the process,” he said.