Mortgage Bankers Association’s loan monitoring survey shows new trends

Over 96% of homeowners have caught up on their mortgage payments, according to the Mortgage Bankers Association’s latest loan monitoring survey, which records the total number of loans in forbearance each month.

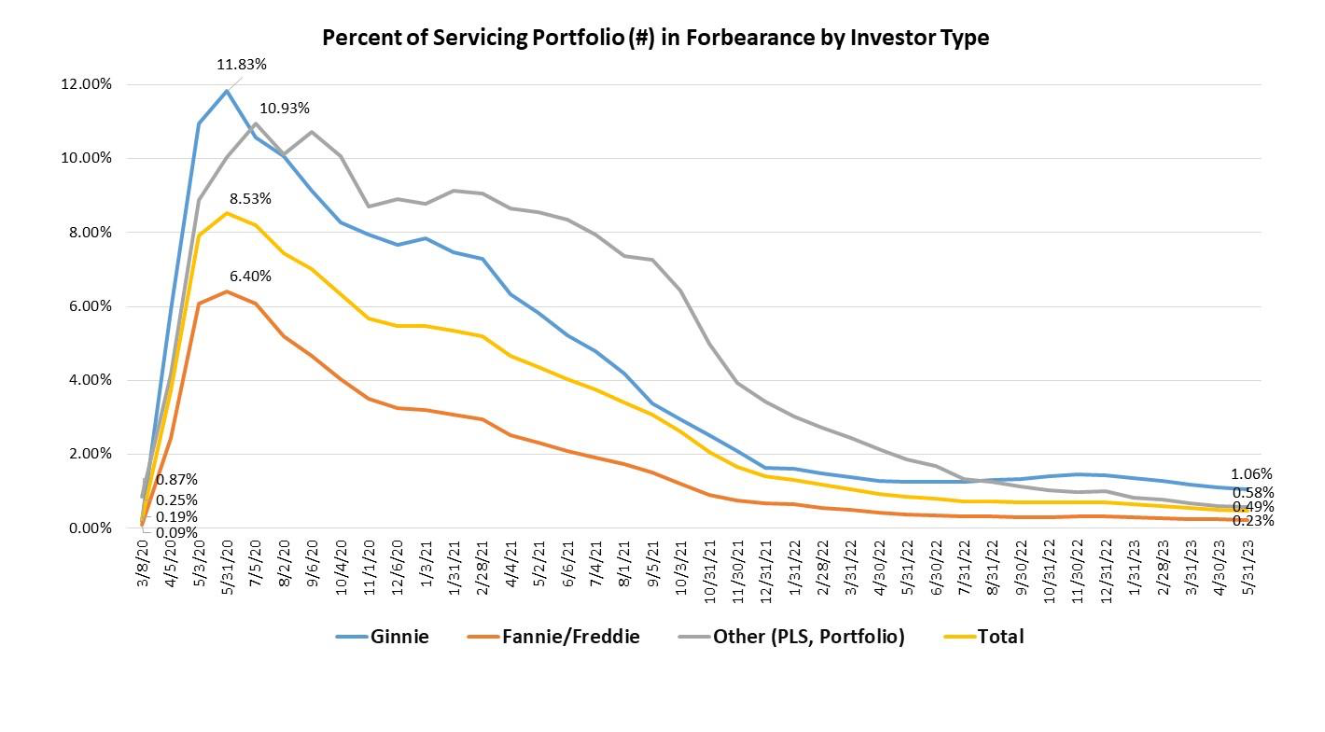

As of May 31, the total number of loans in forbearance shrank by two basis points from 0.51% of servicers’ aggregate portfolio volume in April to 0.49%. MBA estimates that this means 245,000 homeowners in the US are currently in forbearance plans.

The share of Ginnie Mae loans in forbearance decreased the most on a monthly basis, falling from 1.11% in April to 1.05%. The share of Fannie Mae and Freddie Mac loans in forbearance also dipped in May – from 0.24% in April to 0.23% – while the share of portfolio loans and private-label mortgage-backed securities in forbearance decreased from 0.61% in April to 0.58% in May.

Mortgage servicers have provided forbearance to nearly eight million borrowers since the onset of COVID in March 2020, the MBA said.

The total share of serviced loans that were current, i.e. not delinquent or in foreclosure, increased from 95.89% to 96.12% on a monthly basis. Current loan levels have not been this high since Congress passed the two-trillion-dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 to pre-empt the economic damage of the pandemic, MBA vice president of industry analysis Marina Walsh pointed out.

“Today, more than 96% of homeowners are current on their mortgages, thanks to the favorable jobs market and the success of loss mitigation options over the past three years,” Walsh said.

Analysing loans in forbearance by stage, MBA found that 35% of total loans in forbearance were in their initial plan stage, while 52.6% were in a forbearance extension. The rest were forbearance re-entries or re-entries with extensions.

The share of monthly forbearance exits in proportion to the cumulative servicing portfolio volume increased last month by one basis point to 0.11%.

The MBA combined the data for forbearance exits from June 1, 2020 through May 31, 2023 and found that:

- Almost 30% (29.6%) of forbearance exits resulted in a loan deferral or partial claim,

- Eighteen per cent (18%) represented borrowers who were continuing to make their monthly payments during the forbearance period,

- An almost equal proportion represented borrowers who did not make all their monthly payments and exited without a loss mitigation plan,

- Over 15% (16.1%) resulted in a loan modification,

- Just over 10% resulted in reinstatements, and

- Roughly 6.6% resulted in loans paid off by selling the home or a refinance.

Learn the reason on why would you refinance your house in this article.

As of May 31, the five states in the US with the highest share of current loans were Washington, Idaho, Colorado, California, and Oregon, while the five states with the lowest share of current loans were Louisiana, Mississippi, West Virginia, New York, and Indiana.

The next issue of the monthly loan monitoring survey will be published on July 17.