Mortgage lending standards ease amid refinance surge

Lenders relaxed their credit standards and expanded loan offerings in July as borrowers rushed to take advantage of falling mortgage rates, according to the latest data from the Mortgage Bankers Association (MBA).

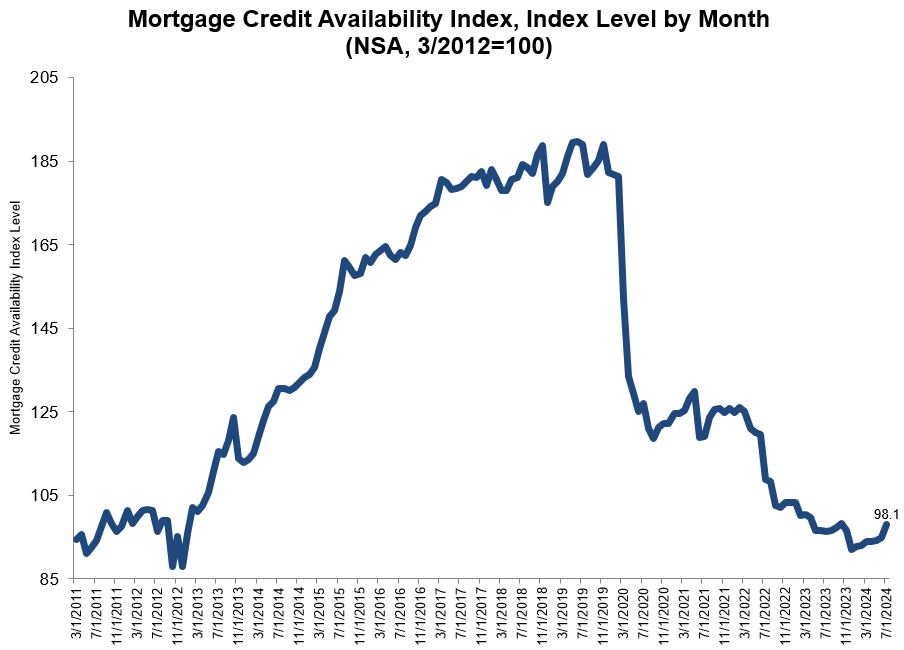

MBA’s latest Mortgage Credit Availability Index (MCAI) rose by 3.3% to 98.1 in July, reaching its highest reading since October 2023. This indicates a loosening of credit, with lenders expanding their loan offerings.

Joel Kan, MBA vice president and deputy chief economist, highlighted that the credit expansion was driven by an increase in conventional loan options, particularly adjustable-rate mortgages (ARMs) and cash-out refinance loans.

“We also saw credit supply expand for jumbo loans, particularly in the non-QM space,” Kan added. “Industry capacity has been low for some time, but we have now seen more than six months of credit expansion, which should be supportive for homebuyers and refinance borrowers, as rates have declined in recent weeks.”

The MCAI gains was fueled by a notable 6.4% increase in the availability of conventional loans, with jumbo loans surging 9.3% and the conforming loan edged up 0.7%. However, the index for government-backed loans, such as those from the FHA and VA, saw a slight decline of 0.1%.

The relaxation in lending standards coincided with a significant uptick in refinancing activity as homeowners raced to refinance their loans and potentially lower their monthly payments.

The MBA’s refinance index surged 16% last week, reaching a two-year high. Refinance applications were up nearly 60% compared to the same week last year.

Read more: Mortgage rate drop spurs application surge

Despite the refinancing boom, the demand for new home loans remains subdued. Applications for home purchase loans inched up by just 0.8% from the previous week and were down 11% compared to the same time last year.

“For-sale inventory is beginning to increase gradually in some parts of the country and homebuyers might be biding their time to enter the market given the prospect of lower rates,” said Kan.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.