Mortgage market sees slight loosening in credit standards

Getting a mortgage became slightly easier in January, according to the latest data from the Mortgage Credit Availability Index (MCAI) released by the Mortgage Bankers Association (MBA).

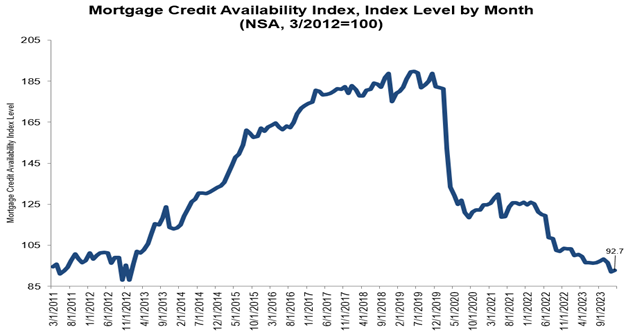

The MCAI saw a modest increase of 0.7%, bringing it up to 92.7 in January. This index measures how tight or loose mortgage lending standards are, with higher numbers indicating easier credit access. It was benchmarked to 100 in March 2012.

“There was a slight increase in credit availability in January, driven by a greater number of conventional loan program offerings,” said Joel Kan, MBA’s deputy chief economist. “However, overall credit availability remained close to 2012 lows, and the conventional index was close to its record low in the series dating back to 2011.”

The availability of conventional mortgage loans saw a bit more of an uptick, increasing by 1.3%. On the other hand, government loan supply didn’t budge. Within the conventional loans category, jumbo loan availability (loans exceeding conforming loan limits) rose by 1.9%, while the availability of conforming loans (loans within set limits) edged up by 0.2%.

Read more: What could conforming loan limits mean to your mortgage?

Read next: Mortgage broker turns the tables on disability tax dilemmas

“Even though there was an increase in cash-out refinance programs available, credit supply overall is tight,” Kan said. “The challenging lending environment has pushed many lenders to reduce costs by cutting back on certain aspects of their business, including exiting origination channels, which has contributed to lower credit supply.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.