Mortgage performance remains quite healthy, boosted by steady employment numbers

US mortgage delinquency rates hit an all-time low in May thanks to a solid labor market that continues to help borrowers pay their mortgages on time.

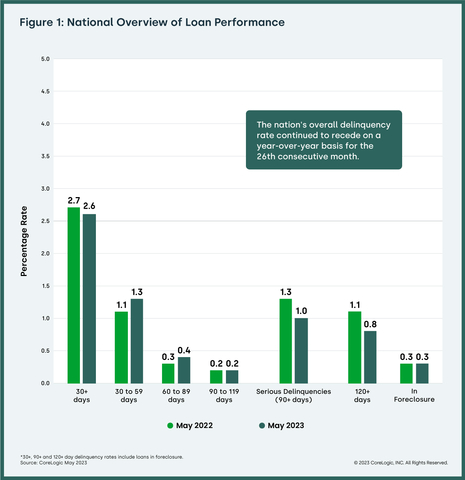

CoreLogic has released its latest loan performance insights report, showing a 0.1% month-over-month drop in delinquencies in May. This brings the share of all delinquent mortgages down to 2.6%.

Of this overall figure, 1.3% were in early-stage delinquency (30 to 59 days past due), up from 1.1% a year ago. Adverse delinquencies (60 to 89 days past due) were up three basis points annually to 0.4%, while serious delinquency rate (90 days or more past due, including loans in foreclosure) fell from its pandemic high of 4.3% to 1% in May.

“Mortgage delinquency rate again fell to a historic low in May, returning to the level seen in March of this year, while the near-all-time low foreclosure rate has not changed since spring 2022,” CoreLogic noted in its report. “However, 14 states and nearly 170 metropolitan areas saw overall delinquencies increase year over year in May, similar to April data. Still, despite this pattern and gradually declining US home price gains over the past year, overall mortgage performance remains quite healthy, boosted by steady employment numbers.”

The foreclosure inventory rate stayed unchanged at 0.3%, and the transition rate, or the percentage of loans that transitioned from current to 30 days past due, hovered at 0.6% in May.

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit,” said CoreLogic principal economist Molly Boesel. “Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.

“The US economy has added nearly 25 million jobs since April 2020 and about four million in the last year. As a result, the unemployment rate has ranged from 3.4% to 3.7% for the past 16 months. While the job market may slightly weaken over the next year, we project that mortgage performance will remain healthy.”

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.