However, MBA expects slowing economy to lead to higher delinquencies later in the year

Only 220,000 US homeowners remain in active forbearance plans, according to the Mortgage Bankers Association (MBA), as mortgage borrowers see improvement in their financial health.

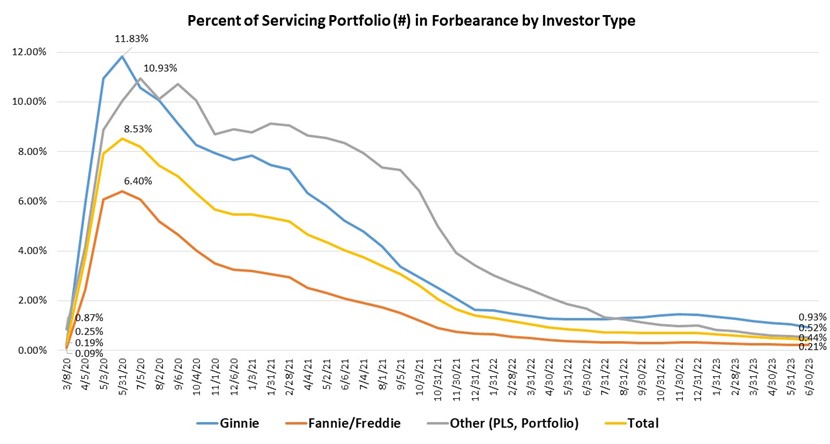

MBA's monthly loan monitoring survey revealed that the total number of loans currently in forbearance fell five basis points in June to 0.49% of servicers' portfolio volume. Mortgage servicers have provided forbearance to roughly 7.9 million borrowers since March 2020.

Marina Walsh, vice president of industry analysis at MBA, attributed the decline in forbearance rate to the steady job growth seen in recent months and its subsequent impact on homeowners' ability to pay their mortgage.

"Mortgage forbearance has declined because most homeowners have maintained or improved their financial health," Walsh said in MBA's news release. "Recent reporting by the US Bureau of Labor Statistics shows continued job growth in June and a 3.6% unemployment rate. The employment situation tracks with homeowners' ability to make mortgage payments."

The portion of Fannie Mae and Freddie Mac loans in forbearance dropped two basis points to 0.21%, while the forbearance rate of Ginnie Mae loans saw a stepper decline of 13 basis points to 0.93% in June. The forbearance share for portfolio loans and private-label securities (PLS) decreased six basis points to 0.52%.

"MBA forecasts a slowing in the economy that could give rise to higher unemployment and mortgage delinquencies later in the year," Walsh said. "Forbearance remains a viable loss mitigation option for homeowners who may struggle under more challenging economic conditions."

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.