MCT reports growth in May lock activity amid mixed economic signals

Mortgage lock volume has increased month over month – but the industry remains cautious as the Federal Reserve weighs how long to hold interest rates.

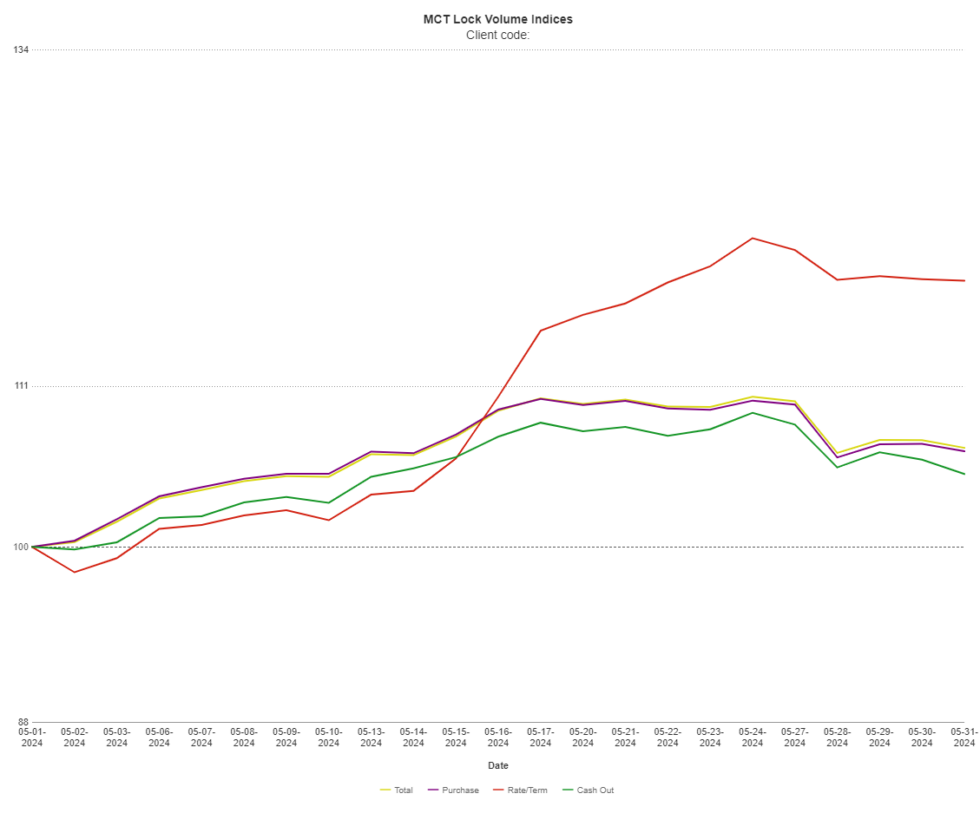

Mortgage lock volume ticked up 6.78% in May compared to April, according to data from Mortgage Capital Trading’s (MCT) latest report.

The rise in mortgage lock volume reflects growing activity in the housing market. The industry's attention, however, is primarily on the Federal Reserve's upcoming decisions, which are influenced by recent economic data.

Recent economic indicators have presented a mixed picture. The April Consumer Price Index (CPI) met expectations, suggesting stable inflation levels. However, the May non-farm payroll report exceeded forecasts, with an additional 272,000 jobs, highlighting a strong labor market.

With the Federal Reserve aiming for a 2% inflation target, the combination of the non-farm payroll report and the upcoming CPI data is crucial. These indicators will guide the Fed's decision on whether to hold rates steady or proceed with anticipated rate cuts.

Read next: 'Fed-unfriendly' jobs report may put its rate cut plans on hold

The Mortgage Bankers Association forecasts the first rate cut to occur in September. However, the timing and extent of any rate changes will depend heavily on how economic data evolves in the coming months.

“Although this report is not uniformly strong, on net, it is showing a job market that is still quite tight, which likely means that the Federal Reserve will continue to hold at its current level of rates, as inflation is unlikely to drop back to target given this pace of wage growth,” MBA chief economist Mike Fratantoni said in a statement.

Andrew Rhodes, senior director and head of trading at MCT, commented: “The next couple of months will be key from a data standpoint as the Federal Reserve looks for a trend of inflation heading towards the goal of two percent. Considering the Nonfarm Payroll number that just came out, setting a trend is going to take more time.

“We’re looking ahead to the May CPI print to see how the Fed is going to interpret both data points. Even with CPI coming in around expectation, the jobs number could likely push the Fed to further delay their rate cuts.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.