But affording the down payment is a bigger issue says Zillow

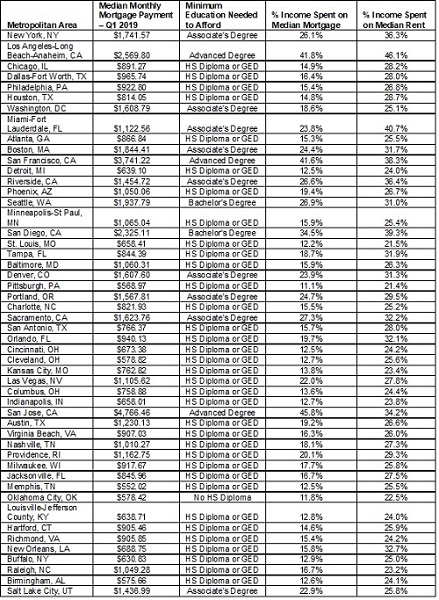

Monthly mortgage payments for a home in most large US metros would not be a problem for households with at least one person with a high school diploma or GED.

That’s according to an analysis from Zillow, which says that first-time buyers in particular are challenged by down payments due to rising home prices.

With lower mortgage rates, 36 of the 50 largest metros are affordable for high school grads, but in the remaining 14 metros buyers will need earnings associated with at least a two-year associate's degree.

"The influx of highly educated workers into already-expensive metros with stagnant or slow-growing inventory has made it difficult for those with less education and earning potential to enter those markets," said Skylar Olsen, director of economic research at Zillow.

But while in Oklahoma City, even households earning the median income for those without a high school diploma are able to afford a typical mortgage payment; in San Diego and Seattle metros, a four-year college degrees are generally required.

"There can also be considerable variation within metros,” added Olsen. “While a bachelor's degree may be enough to afford a mortgage on the typical home in the San Diego metro at large, it's likely to be insufficient in pricey areas like La Jolla. And that's only after scraping together a sizable down payment, which is a huge hurdle for most buyers."