Three weeks of falling rates spark optimism for homebuyers and lenders

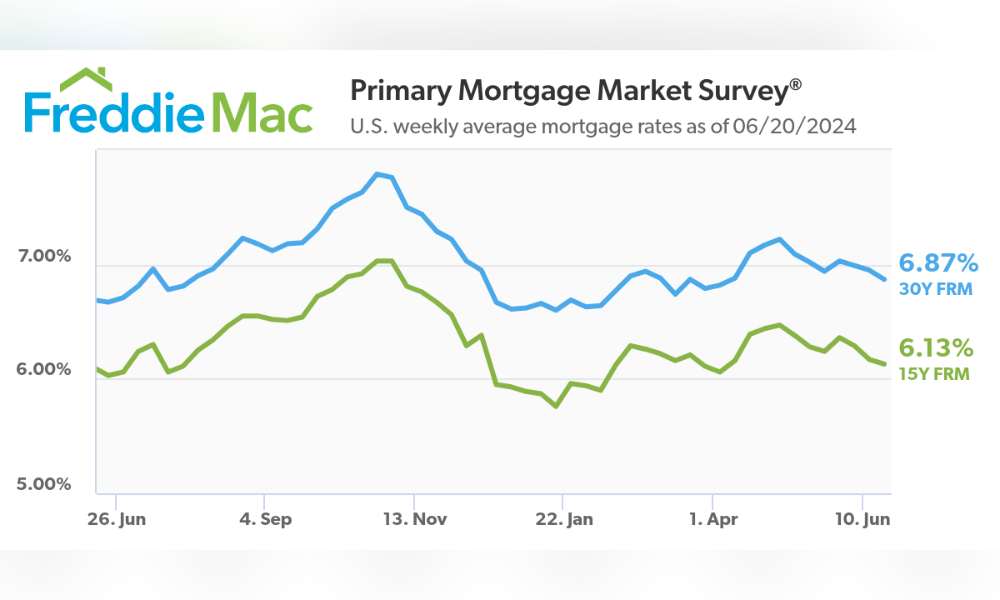

Mortgage rates are continuing to ease, falling for the third consecutive week to their lowest level in three months, according to Freddie Mac's latest Primary Mortgage Market Survey (PMMS).

This decline follows recent signs of cooling inflation and market expectations of a potential Federal Reserve rate cut.

The 30-year fixed-rate mortgage (FRM) averaged 6.87%, down from 6.95% the previous week. However, this rate is slightly higher than the 6.67% recorded a year ago. The 15-year FRM dipped to 6.13%, down from 6.17% last week and 6.03% a year ago.

Market analysts attribute the decline in mortgage rates to a recent inflation report showing a drop in the year-over-year core consumer price index, its lowest level in over three years.

“Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut,” Freddie Mac chief economist Sam Khater said in the PMMS report. “These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.”

“An encouraging inflation report sent mortgage rates downward in the last week,” added Holden Lewis, home and mortgage expert at NerdWallet. “The year-over-year core consumer price index fell to its lowest level in more than three years, which is good news for mortgage rates. They would have fallen even more had the Federal Reserve declared victory over inflation in last week's meeting. But the Fed indicated that it's still in inflation-fighting mode, tempering the decline in mortgage rates. Lenders don't adjust mortgage rates in unison, so it's important to shop and compare offers.”

The decrease in mortgage rates has led to a modest uptick in mortgage applications.

The Mortgage Bankers Association (MBA) reported a 0.9% rise in mortgage application volume. Refinance applications decreased slightly by 0.4% but remained 30% higher than the same period last year. The seasonally adjusted purchase index increased by 2% from the prior week, though it was still 12% behind last year's levels.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.