The 30-year fixed mortgage rate continues to soften as buyers wait on Fed decision

Mortgage rates have fallen to their lowest point in 18 months, as the market continues to soften in anticipation of the Federal Reserve’s next rate cut.

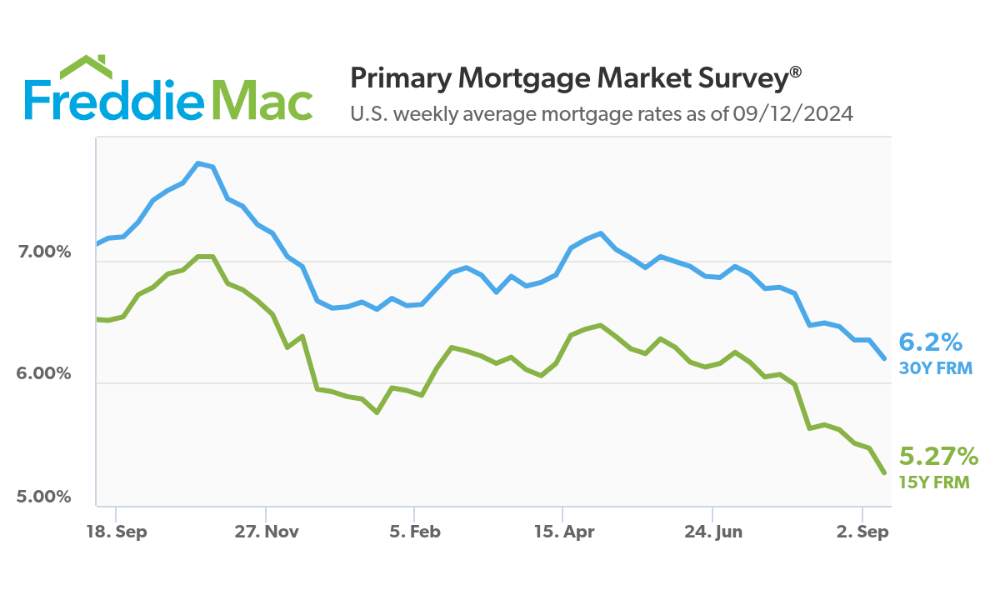

The average rate for a 30-year fixed mortgage fell to 6.20% as of September 12, down from 6.35% last week. A year ago, the 30-year fixed rate stood at 7.18%, according to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS).

“Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February 2023,” said Freddie Mac chief economist Sam Khater. He added that while the drop in rates is welcome news, prospective homebuyers remain hesitant due to high home prices and ongoing supply shortages.

“Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February 2023,” said Freddie Mac chief economist Sam Khater. He added that while the drop in rates is welcome news, prospective homebuyers remain hesitant due to high home prices and ongoing supply shortages.

“Rates continue to soften due to incoming economic data that is more sedate,” Khater noted in the PMMS report. “But despite the improving mortgage rate environment, prospective buyers remain on the sidelines, as they negotiate a combination of high house prices and persistent supply shortages.”

The 15-year fixed-rate mortgage also saw a decrease, averaging 5.27%, down from 5.47% the prior week and from 6.51% last year.

Holden Lewis, a home and mortgage expert at NerdWallet, noted that rates are likely to stay relatively stable until the Federal Reserve’s upcoming monetary policy meeting.

“The Fed is expected to cut short-term rates, and mortgage rates already have dropped in anticipation of that. That means mortgage rates will remain relatively unchanged until the Fed meeting,” Lewis said.

Read next: Is a supersized Fed rate cut on the way?

Although the drop in mortgage rates has not yet led to a significant uptick in home-buying activity, some analysts see it as a sign that the housing market may be on the mend.

Odeta Kushi, deputy chief economist of First American, explained how rate changes often precede broader economic shifts.

“The housing market is notoriously interest rate sensitive,” Kushi wrote in a note. “When the economy overheats or inflation flares up, the Federal Reserve (Fed) often raises the federal funds rates, which can slow the housing market and the broader economy too. Once the Fed starts cutting rates, the housing market typically perks up again.”

Kushi pointed out that the housing market may have narrowly avoided a recession.

“If you’re worried about our current economic cycle, we have some good news,” she said. “While the housing market flirted with a recession in May and June, it didn’t fully commit, and July is already showing signs of a comeback.

“Mortgage rates fell in July and August, which improved affordability and eased the rate lock-in effect. While this rate drop has not yet spurred a significant rebound in housing activity, it provides a glimmer of optimism that the peak risk of a housing recession may be behind us.”

What happens to mortgage rates in the Unites States during a recession? Do they climb or drop? Will your home loan be affected? Find out in this article.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.