Market responds to shifting economic trends

Mortgage rates rose for the first time in four weeks, according to Freddie Mac’s latest Primary Mortgage Market Survey released Thursday.

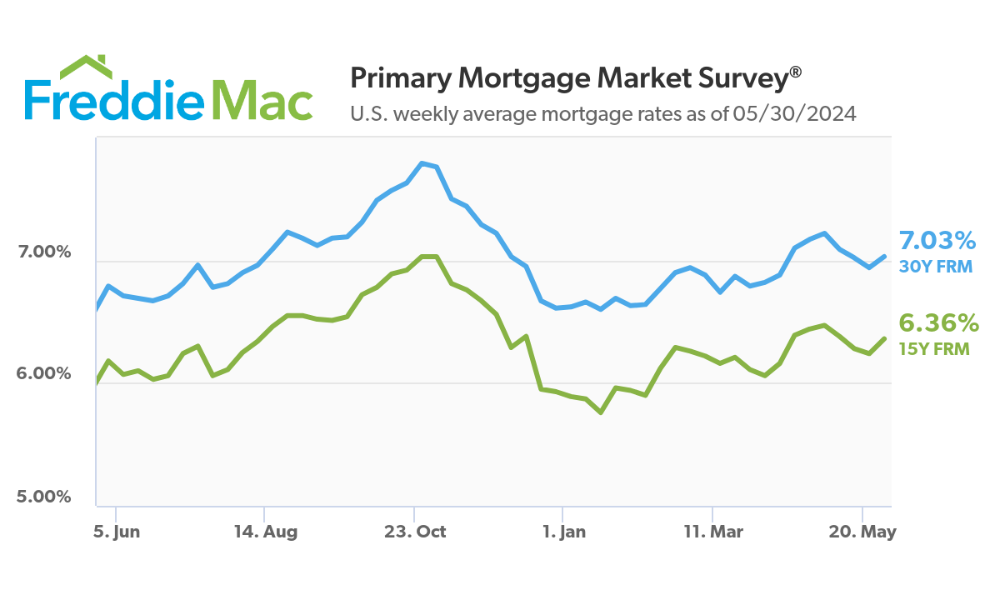

The 30-year fixed-rate mortgage averaged 7.03% for the week ending May 30, up from 6.94% the previous week.

“Following several weeks of decline, mortgage rates changed course this week,” Freddie Mac chief economist Sam Khater said in the report. “More hawkish commentary about inflation and tepid demand for longer-dated Treasury auctions caused market yields to rise across the board.”

Khater added that mixed economic signals over recent weeks have “resulted in mortgage rates drifting higher as markets continue to dial back expectations of interest rate cuts.”

This was the first weekly increase for the 30-year rate since early May. A year ago, the 30-year fixed-rate mortgage averaged 6.79%.

The 15-year fixed-rate mortgage also rose to an average of 6.36%, up from 6.24% the prior week and 6.18% a year earlier.

Read more: Should homebuyers wait for rates to fall or make a move now?

Holden Lewis, home and mortgage expert at NerdWallet, commented: “Mortgage rates went up this week in reaction to a report that economic output jolted higher in May. A vigorously growing economy could sustain inflation, which in turn would push upward on mortgage rates.”

However, Lewis noted conflicting economic signals raise the possibility that “this could be a short-lived upward blip” for mortgage rates.

The rate hike weighed on mortgage demand last week, with total mortgage application volume falling 5.7%, according to the Mortgage Bankers Association.

“The uptick in rates led to a decline in mortgage applications heading into Memorial Day weekend,” said Joel Kan, vice president and deputy chief economist at MBA. “Both purchase and refinance applications fell, pushing overall activity to the lowest level since early March.”

Kan said homebuyers remain sensitive to small increases in rates given the low inventory of affordable homes for sale.

“[This impact] the refinance market and keeping purchase applications below last year’s levels,” he added. “There continues to be limited levels of existing homes for sale, and many buyers are struggling to find listings in their price range that meet their needs.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.