Adjustable-rate mortgages gain popularity amid surging rates

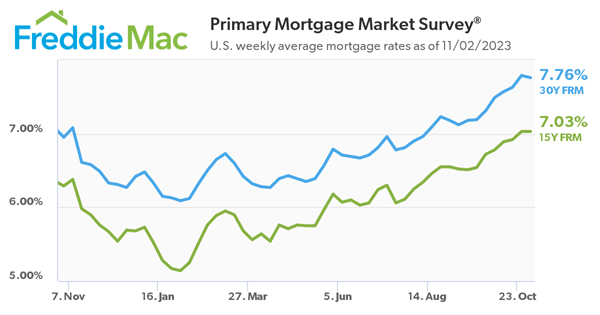

Freddie Mac’s latest survey has revealed a momentary pause in its mortgage rate surge.

After weeks of steady increases, the average 30-year fixed-rate mortgage (FRM) dropped two basis points to 7.76% this week. A year ago, the 30-year FRM stood at 6.95%, indicating a notable increase over the past year.

The 15-year fixed-rate mortgage showed no change, holding steady at an average of 7.03% compared to the previous week. This time last year, the 15-year FRM averaged 6.29%.

“The 30-year fixed-rate mortgage paused its multi-week climb but continues to hover under 8%,” Freddie Mac chief economist Sam Khater said in the report. “The Federal Reserve again decided not to raise interest rates but has not ruled out a hike before year-end. Coupled with geopolitical uncertainty, this ambiguity around monetary policy will likely have an impact on the overall economic landscape and may continue to stall improvements in the housing market.”

The stubbornly high rates have had a noticeable effect on mortgage applications, which declined for the third consecutive week, according to the Mortgage Bankers Association (MBA).

MBA deputy chief economist Joel Kan also noted that as fixed rates climbed, adjustable-rate mortgages continued to gain popularity.

“As higher rates continue to impact affordability and purchasing power, ARM loans increased almost 10% last week and continued to gain share, growing to 10.7% of all applications,” Kan said.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.