"The depressed supply of government credit is particularly significant"

Mortgage supply fell again in May against the backdrop of an industry facing a period of consolidation and reduced capacity, according to the Mortgage Bankers Association.

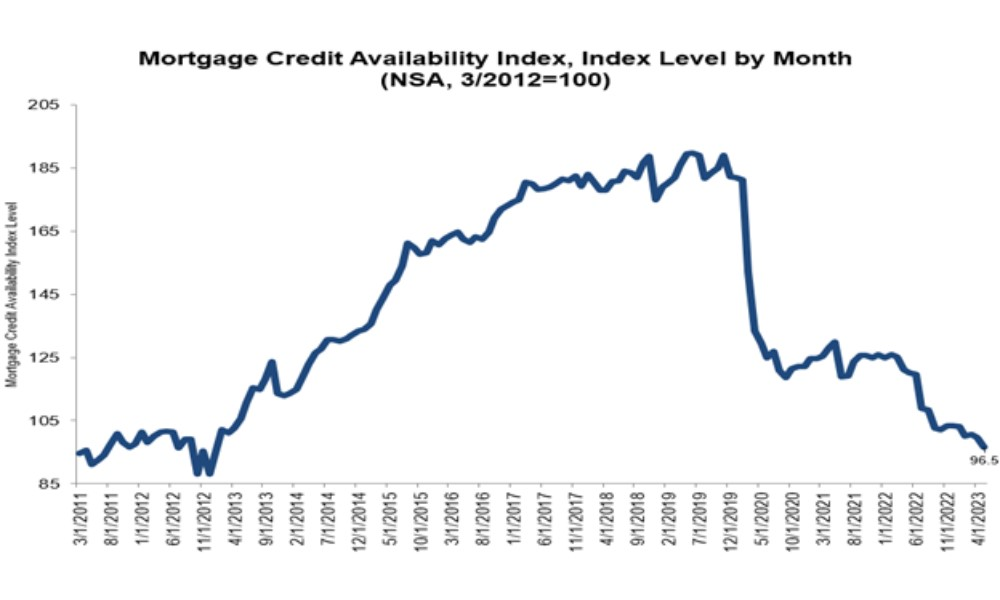

MBA’s Mortgage Credit Availability Index (MCAI) tumbled 3.1% month over month to 96.5 in May, marking the third-straight month of declines and a tightening in lending standards.

“Mortgage credit availability decreased for the third consecutive month, as the industry continued to see more consolidation and reduced capacity as a result of the tougher market,” said Joel Kan, MBA’s deputy chief economist. “With this decline in availability, the MCAI is now at its lowest level since January 2013.”

The Conventional MCAI dropped 2.3%, while the Government MCAI fell 3.8% in May. Of the component indices of the Conventional index, the conforming MCAI slipped 3.9% to its lowest level in the survey’s history dating back to 2011. According to Kan, the jumbo index saw a 1.5% decrease, its first contraction in three months as some depositories assess the impact of recent deposit outflows and reduce their appetite for jumbo loans.

“Additionally, lenders pulled back on loan offerings for higher LTV and lower credit score loans, even as loan applications continued to run well behind last year’s pace,” Kan explained. “Both conventional and Government indices saw declines last month, and the Government index fell by 3.8% to the lowest level since January 2013. In a market where a significant share of demand is expected to come from first-time homebuyers, the depressed supply of government credit is particularly significant.”

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.