But experts see possibilities in rising inventory and Fed rate cut

Pending home sales plummeted to their lowest level since tracking began in 2001, according to the National Association of REALTORS (NAR).

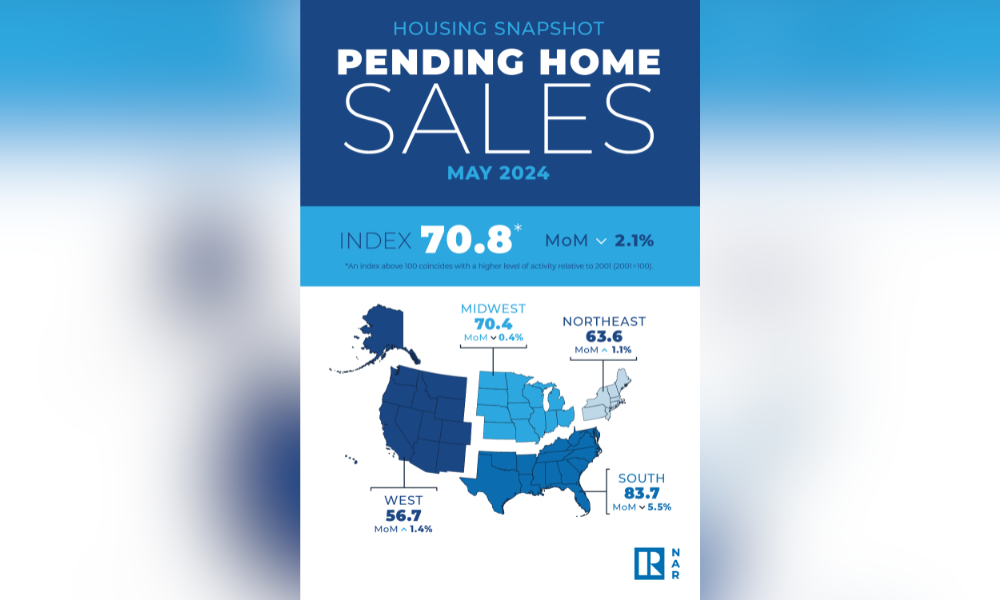

NAR’s Pending Home Sales Index fell for the second month in a row to 70.8 in May, down 2.1% from April and 6.6% from the previous year. This decline was felt across all four regions of the US, with each experiencing a year-over-year decrease in pending sales.

“May’s pending home sales slid 2.1% month over month, not just falling below forecasters’ hopes but hitting an all-time low since the NAR began collecting this data in 2001,” said Kate Wood, mortgage expert at NerdWallet.

“May’s pending home sales slid 2.1% month over month, not just falling below forecasters’ hopes but hitting an all-time low since the NAR began collecting this data in 2001,” said Kate Wood, mortgage expert at NerdWallet.

“The market is at an interesting point with rising inventory and lower demand,” NAR chief economist Lawrence Yun said in the report. “Supply and demand movements suggest easing home price appreciation in upcoming months. Inevitably, more inventory in a job-creating economy will lead to greater home buying, especially when mortgage rates descend.”

Despite the decline, experts believe the housing market may be poised for a change. With more homes becoming available and mortgage rates potentially moderating, there’s a chance for increased buyer activity.

“Pending sales are a forward-looking indicator of home sales based on contract signings, so two consecutive months of declining pending home sales suggest a negative outlook for sales activity,” said First American deputy chief economist Odeta Kushi. “However, these declines occurred when mortgage rates rose in April and May. With rates moderating in June, purchase mortgage applications indicate that rate-sensitive buyers are hesitantly responding.”

The NAR also released its economic forecast for the housing market, predicting that mortgage rates will remain above 6% in 2024 and 2025, even with the Federal Reserve’s recent interest rate cuts.

“If mortgage rates continue their descent alongside rising inventory levels, some buyers may be enticed off the sidelines and boost the summer home-buying season. Nevertheless, a robust summer recovery is unlikely given ongoing affordability constraints,” Kushi said.

Read next: What’s holding back the US housing market?

The association also expects existing home sales to rise to 4.26 million in 2024 (up from 4.09 million in 2023) and to 4.92 million in 2025. Housing starts are projected to increase to 1.382 million in 2024 (from 1.413 million in 2023) and to 1.492 million in 2025.

When it comes to pricing, NAR anticipates a record high for the median existing home prices in 2024, reaching $405,300 (up from $389,800 in 2023). The median new-home price is also expected to climb, reaching $434,100 in 2024 (from $428,600 in 2023) and $441,200 in 2025.

“The first half of the year did not meet expectations regarding home sales but exceeded expectations related to home prices,” Yun said. “In the second half of 2024, look for moderately lower mortgage rates, higher home sales and stabilizing home prices.”

The PHSI breakdown by region showed mixed results. The Northeast saw a slight increase from April but remained down 2.3% year-over-year. The Midwest and South experienced declines in May compared to both the previous month and May 2023. The West PHSI edged up in May but fell slightly compared to May 2023.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.