Black Knight mortgage data shows disparity in the benefit of lower rates

A homebuyer with the national median income buying the median priced home is using the lowest share of their income for mortgage payments in 20 months.

Affordability reached its highest point for several years in August 2019 and continued in September as 30 year mortgage rates fell to 3.46% meaning that a typical buyer would need to spend 20.7% of their monthly income on principal and interest (P&I) mortgage payments.

The payment-to-income ratio is 4.5% below its long-term average (1995-2003) according to the latest Black Knight Mortgage Monitor released today (10/7).

The $1,122 in monthly P&I required to purchase the average home is down 10% from November – when interest rates peaked near 5% – despite home prices rising more than 4% from that point.

“Back in November 2018, we were reporting on home affordability hitting a nine-year low,” said Black Knight Data & Analytics President Ben Graboske. “Interest rates were nearing 5%, pushing the share of national median income required to make the P&I payments on the purchase of the average-priced home to 23.7%. In the time since, rates have tumbled and the affordability outlook has improved significantly.”

Affordability in some markets still tight

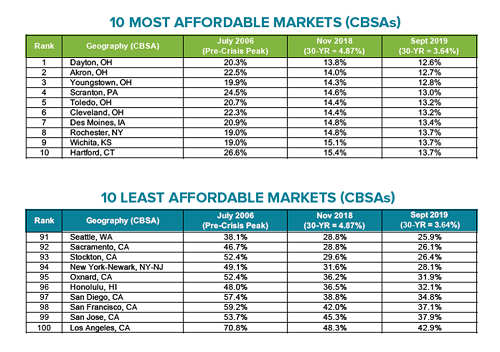

Real estate’s localized nature means that not every homebuyer is seeing their monthly mortgage payments heading towards just a fifth of income.

In pricier markets, buyers will need double the national median P&I payments to buy a median priced home.

In Los Angeles for example, which is the nation’s least affordable market, purchasing the average-priced home requires nearly 43% of the median household income. This is far improved from the 71% that would have been needed in 2006 or the 48% of November 2018.

California has 7 of the 10 least affordable markets.

Looking ahead

Despite falling interest rates and steadily improving affordability over the preceding eight months, annual home price growth held flat in August at 3.8% after rising for the first time in 17 months in July.

“It remains to be seen if this is merely a lull in what could be a reheating housing market, or a sign that low interest rates and stronger affordability may not be enough to muster another meaningful rise in home price growth across the US,” added Graboske. “That the strongest gains in – and strongest levels of – affordability were in August and early September could bode well for September/October housing numbers. As such, we’ll be keeping a close eye on the numbers coming out of the Black Knight Home Price Index over the coming months.”