Report highlights another impact on housing affordability

Another challenge for homebuyers has been highlighted in a new report which has calculated that new homebuyers in states with property tax assessment limits are paying significantly higher tax rates than longer term owners thanks to state tax breaks for long-time owners.

For example, in Miami someone who’s owned their home for the city’s average ownership duration of 13 years would pay around $2,800 while a new owner of similar home paid $5,200.

This discount, the result of state tax breaks for long-time homeowners, was about $450 higher in 2018 than in 2017, according to the annual 50-State Property Tax Comparison Study by the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence.

Regional variations

In the 10 states where tax rates are based on when land parcels were last sold, rising house prices shifts more of the property tax burden onto newer buyers.

Cities with high local sales or income taxes do not need to raise as much revenue from the property tax and thus have lower property tax rates on average.

So, Bridgeport, Connecticut, has one of the highest effective tax rates on the median-valued home, while Birmingham, Alabama, has one of the lowest. But the average Birmingham resident pays 36% more in total local taxes when accounting for sales, income, and other local taxes.

Cities with low property values need to impose a much higher tax rate to raise the same revenue as cities with high property values.

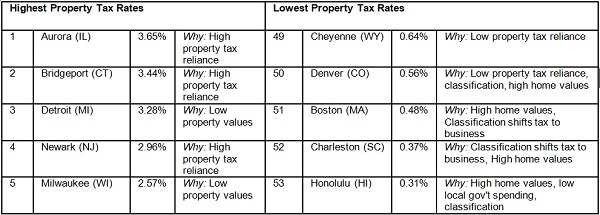

Highest and Lowest Effective Property Tax Rates on a Median-Valued Home (2018)