NRMLA/RiskSpan index hit another all-time high

The housing wealth of US homeowners aged 62 and older reached a new record high in the first quarter of 2019.

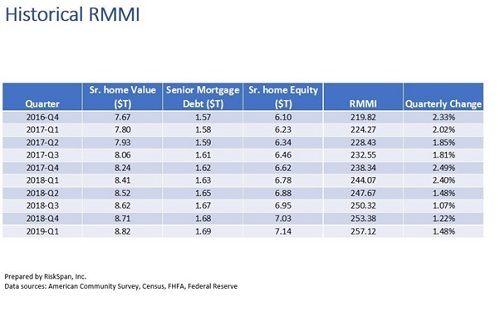

The National Reverse Mortgage Lenders Association says that seniors held $7.14 trillion in housing wealth in Q1 2019, adding $104 billion (2.7%) from the previous quarter.

The gain was driven by a 2.4% or $110 billion increase in senior home values, including an estimated increase of 0.8% in the senior homeowning population, offset by a 1.1% or $6.5 billion increase of senior-held mortgage debt.

The NRMLA/RiskSpan Reverse Mortgage Market Index reached 257.12, its highest mark since its inception in 2000.

"Reverse mortgages have become an essential component for addressing a huge problem for many Americans—funding retirement," said NRMLA President and CEO Peter Bell. "More than 1.12 million families have used a reverse mortgage alongside side their 401(k)s, IRAs, savings, investments, Social Security, Medicare and Medicaid to cover life's daily expenses, so they could live more financially secure lives. As with all major financial decisions, a reverse mortgage should be part of an overall strategic plan, with input from knowledgeable professionals, and family members who may be impacted."