Ten-X says online competition and changing needs keeping vacancy rates high

The vacancy rate for US commercial retail space continues to be elevated amid challenging conditions for bricks and mortar stores.

Transaction platform Ten-X Commercial’s Spring 2019 US Retail Market Outlook reports that the vacancy rate has held at 10.2% from 2018 and are expected to hold level for 2019 and likely until 2022.

Store closures driven by online competition and demand for smaller physical retail space means weaker demand and effective rent growth stalling in the upper-1% range for the past 2 years. The most recent quarterly effective rent growth remained at 0.4%, a slight 1.6% gain from a year ago.

"Despite continued weakness in the overall retail sector, investor sentiment is stronger than it was last year," said Ten-X Chief Economist Peter Muoio. "Given the trend toward retail repositioning and development, investor activity in the sector could remain strong even as fundamentals struggle."

The buy and sell markets

Although retail deal volume in the northeast has historically been high, there has been a surge in the southern markets in recent quarters.

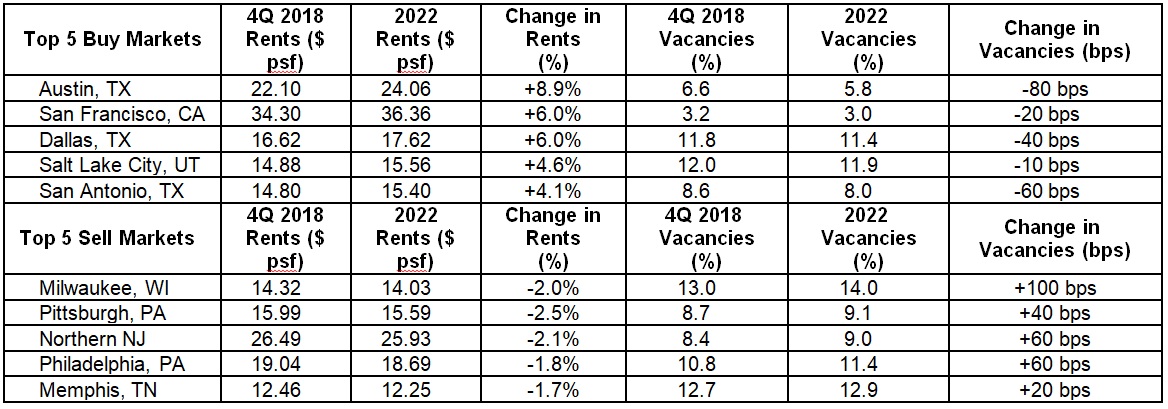

Austin, TX; San Francisco, CA; Dallas, TX; Salt Lake City, UT; and San Antonio, TX have been identified as the top five 'buy' markets for spring 2019. These markets have all seen rent gains and lower vacancy rates. Overall, the Southwest region exhibits better buyer demographics and stronger economies, which provide a boost to traditional retail.

Meanwhile, Milwaukee, WI; Pittsburgh, PA; San Francisco, CA; Northern NJ; Philadelphia, PA; and Memphis, TN have been classified by Ten-X as the top five 'sell' markets. These cities have seen weak rents and higher vacancy rates, and will likely struggle through 2022.

"While the rise of e-commerce is hurting brick and mortar retailers everywhere, some areas of the retail market are holding up better, as retail deal volume has increased in the south and southwest metros," Muoio continued.