Decelerating homebuyer demand leads to lower price growth in some regions

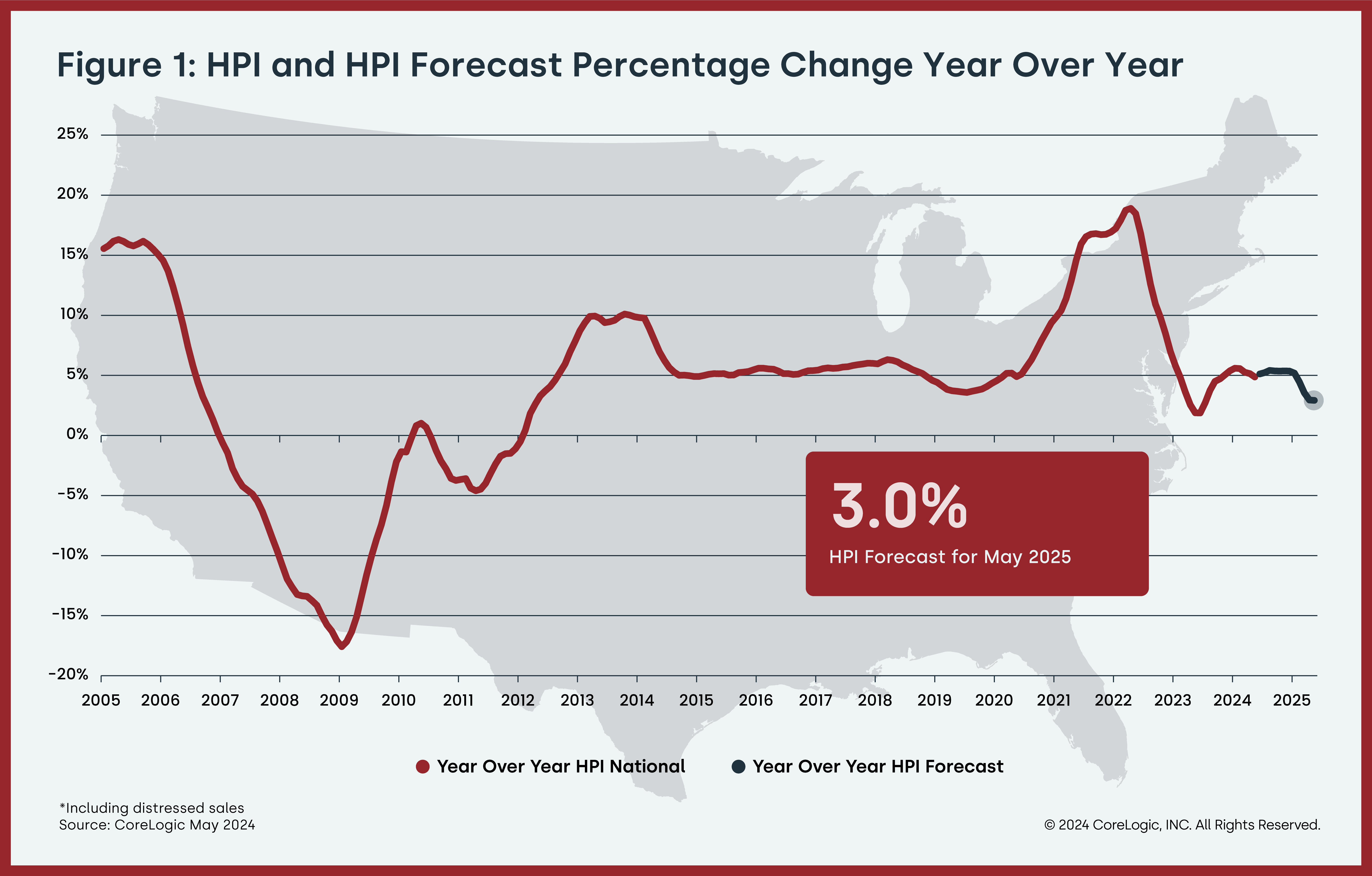

US home price gains decelerated to 4.9% year-over-year in May 2024, marking the 148th consecutive month of annual growth but showing a clear slowdown in response to rising mortgage rates.

On a month-over-month basis, home prices increased by 0.6% from April to May, the latest CoreLogic Home Price Index (HPI) showed.

This deceleration reflected weakening homebuyer demand and cooling prices caused by the spring surge in mortgage rates, CoreLogic chief economist Selma Hepp said.

“While national annual home price growth continues to slow as anticipated, cooling appreciation over the past months is now observed in more markets, as the surge in mortgage rates this spring caused both slowing homebuyer demand and prices,” Hepp said in the report. “However, persistently stronger home price gains this spring continue in markets where inventory is well below pre-pandemic levels, such as those in the Northeast.”

The data also revealed a widening gap between appreciation rates for detached and attached homes. Detached properties saw 5.4% annual appreciation, 2.6 percentage points higher than attached properties at 2.8%.

CoreLogic suggested this might reflect homebuyer preferences for more personal space to work from home after the height of the pandemic, as well as surging HOA fees due to maintenance costs.

Read next: What's holding back the US housing market?

Despite the overall deceleration, regional disparities persist. The Northeast continued to lead in annual appreciation, with New Hampshire being the only state to post a double-digit increase at 12%. New Jersey and Rhode Island followed closely, both up by 9.8%. No state recorded a year-over-year home price loss.

Among major metro areas, San Diego topped the list with a 9.2% year-over-year increase, followed by Miami at 8.5%.

“Markets that are relatively more affordable, such as those in the Midwest, have seen healthy price growth this spring,” Hepp said. “On the other hand, markets with notable inventory increases, including those in Florida and Texas, continue to see annual deceleration that is pulling prices below numbers recorded last year.”

CoreLogic’s forecast predicts that annual US home price gains will relax to 3% by May 2025.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.