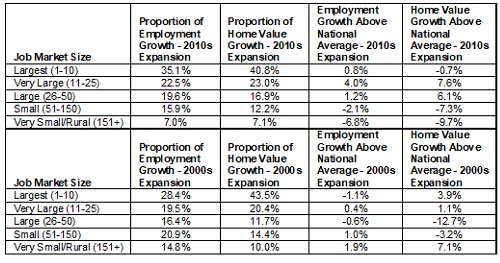

Home values and job creation have both lagged big cities

.jpg)

A lower rate of job creation has dampened the ability of America’s rural areas to recover from the Great Recession.

An analysis from Zillow shows that the 25 largest job markets have accounted for more than half of employment growth and nearly two-thirds of home value growth since July 2019.

The analysis highlights that the rapid growth in home values and therefore the increased amount needed for a down payment, are a key reason why homeownership rates among young people in the years since the Great Recession are lower than those during the previous economic expansion of the early-to-mid 2000s.

"The striking difference between the two periods of recent economic expansion is the contrast between more balanced growth across the U.S. in the early 2000s, to a fairly consistent pattern of rural and small markets being left behind as jobs and home value growth concentrate in large markets," said Skylar Olsen, director of economic research at Zillow.

Olsen added that rural and small markets are facing the continuing struggles of the jobs market where manufacturing and agriculture are concentrated. But there are also challenges for large markets.

“It's not only about job vitality but also a city's ability to increase the amount of housing to meet that influx of workers,” he said. “Job concentration increasingly means that already expensive metros are becoming even more expensive at a faster rate than before."

Second-tier markets have seen the strongest growth including Seattle and Pittsburgh. These metros have seen average employment growth of 4% above the national average and average home value growth of 7.6%.