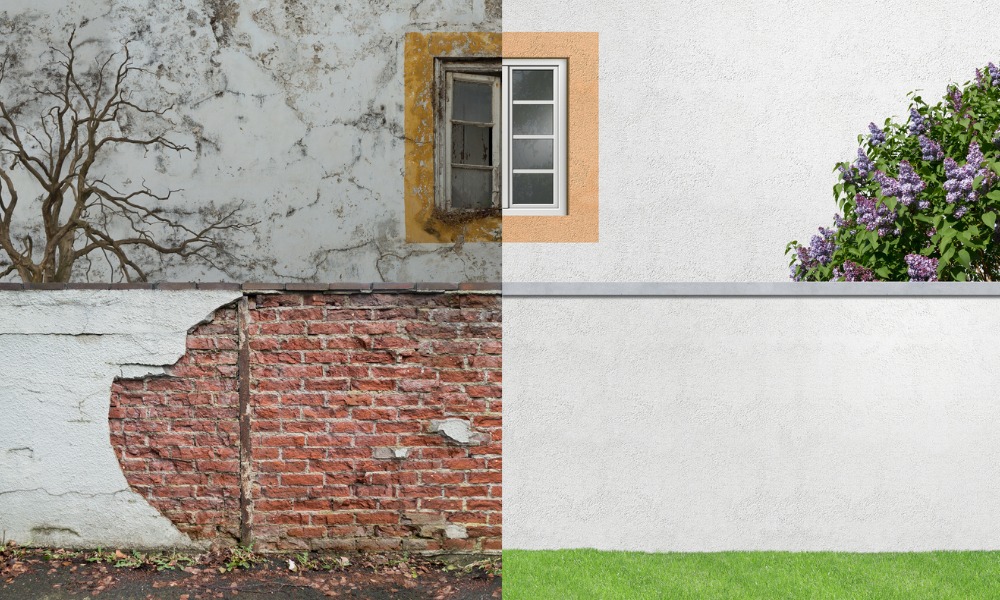

The dream home of the past is now just a fixer-upper

Buying a starter home has become slightly more affordable, but the definition of a "starter home" has evolved, according to a new report from Redfin.

While the annual income required to afford the median-priced starter home dropped 0.4% to $76,995 in August 2024, this improvement is tempered by changing market realities. Mortgage rates have dropped from 7.07% to 6.08%, offsetting the 4.2% increase in home prices, Redfin noted.

Despite this, starter homes today are often smaller fixer-uppers, far from the traditional four-bedroom houses buyers could afford a decade ago.

“It’s great news that starter homes are becoming a little more affordable, but there’s a catch,” said Redfin senior economist Elijah de la Campa. “Starter homes aren’t what they used to be. A decade ago, a turnkey four-bedroom house in a nice neighborhood was often considered a starter home, but today, a small fixer-upper condo is often all a first-time homebuyer can afford. The American Dream is changing; for many, it no longer involves a house and a white picket fence.”

Affordability improvements may be short-lived. Mortgage rates have largely priced in the Federal Reserve’s recent cuts, so future rate reductions are unlikely to significantly ease housing costs. Additionally, rising home prices mean that waiting to buy could result in even steeper costs and larger down payments.

Although household incomes have increased by 8.9% over the last year, the gap between earnings and home prices has widened dramatically since before the pandemic. Redfin’s report showed that the typical household now earns just 3.6% more than is needed to afford a starter home – down from a 57.1% surplus in 2019 and a 113% surplus in 2012. Since 2019, home prices have risen by 51.1%, far outpacing the 33.4% rise in incomes.

Three-quarters of current starter-home listings are technically affordable for households earning the median income, up from 72.6% last year. However, this is a significant decline from the near 100% affordability levels seen in 2019. Households earning 80% of the median income can only afford 43.1% of starter homes, further highlighting the growing affordability crisis.

“While many people make enough on paper to afford a starter home, they often have other expenses like student debt that are preventing them from buying,” said Blakely Minton, a Redfin Premier real estate agent in Philadelphia. “Starter-home buyers are skewing older than they used to.

Read next: How long before the US mortgage market heats up again?

“When I first started working in real estate 20 years ago, they were kids fresh out of college. Now grads are saddled with huge student loans and are moving back in with Mom and Dad or renting. I bought my first house at 23, but that’s hard to do today, in part because first-time buyers are competing with older Americans who want to downsize and are able to make higher offers.”

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.