In the hottest markets, rents are double the national average

The strength of the US economy is a double-edged sword for the housing market.

While economic prosperity boosts the labor market, that in turn means more demand for rentals homes, pushing rents higher. That’s good news for landlords but adds further pressure for those wanting to become homeowners but challenged by down payments.

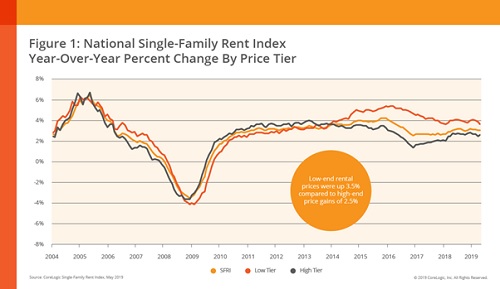

CoreLogic has today published its Single-Family Rent Index which analyzes the rental market across the 20 largest US metros. It reveals that the nationwide average rent increased 3% in May 2019, picking up pace from the 2.8% increase seen in May 2018. However, this is down from the 4.1% peak of rental growth seen in 2016.

“Single-family rents increased the most in metros with high employment growth in May 2019,” said Molly Boesel, principal economist at CoreLogic. “Job growth in Phoenix, Orlando, and Las Vegas doubled the national average during May – stimulating increased rental demand in these markets and therefore driving rent prices upward.”

The average rent in Phoenix gained 7.4% year-over-year in May while Tucson, Arizona gained 6.3% and Las Vegas gained 6.1%.

Meanwhile, Houston tied for the lowest rent increases of all analyzed metros at 1%, the lowest year-over-year rent increase in the metro since October 2017 (0.8%), likely due to the waning effects of the 2017 hurricane season.

Low-end rentals rising fastest

The low-end rental market is seeing greater increases though with properties with rent prices less than 75% of the regional median posting a 3.5% year-over-year increase in rents (down from 3.9% in May 2018), while high-end rentals (125% or more of regional median) showed a 2.5% increase (up from 2.4% a year earlier).