Most borrowers paid on time, forbearance rates slightly decline

Most homeowners made their mortgage payments on time in May, according to the latest data from the Mortgage Bankers Association (MBA).

The delinquency rate held steady at a very low 0.21% in May, which translates to roughly 105,000 borrowers currently in forbearance plans. MBA’s latest Loan Monitoring survey highlighted a positive trend in on-time payments, with the percentage of current loans increasing slightly to 96.14% in May.

“The performance of servicing portfolios in May was solid, with about 96% of borrowers making their mortgage payments on time,” said Marina Walsh, vice president of industry analysis at MBA.

Breaking down the data by loan type, Fannie Mae and Freddie Mac loans in forbearance decreased from 0.11% to 0.10%. Meanwhile, Ginnie Mae loans remained steady at 0.39% and portfolio loans and private-label securities held at 0.31%.

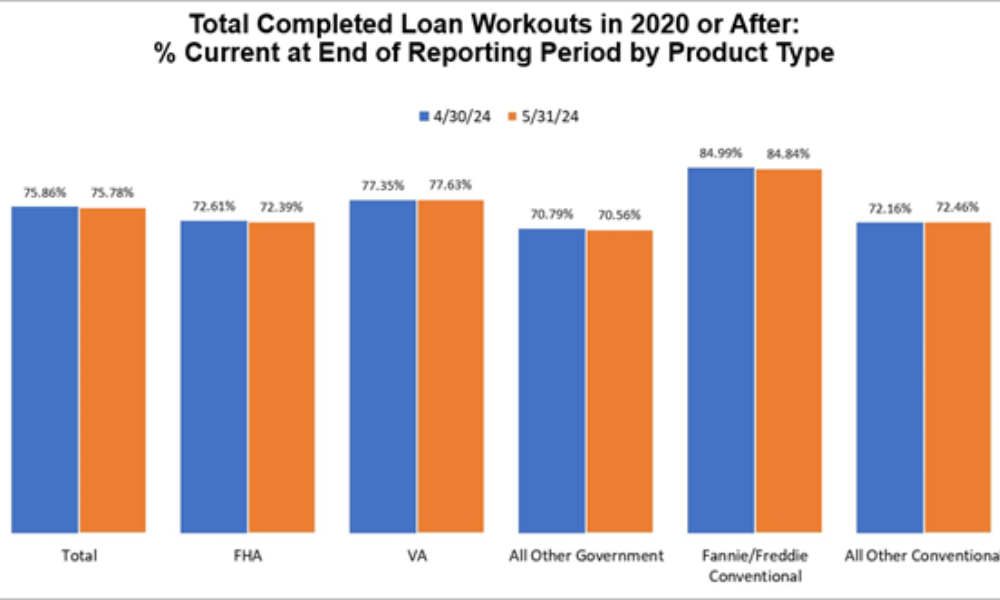

However, Walsh pointed out a slight decline in the performance of post-forbearance loan workouts.

However, Walsh pointed out a slight decline in the performance of post-forbearance loan workouts.

The data shows that 75% of borrowers who exited forbearance are still making their payments according to their workout agreements. This suggests the vast majority are transitioning smoothly back to regular payments. However, the remaining 25% who are struggling highlight the ongoing challenges some homeowners face.

Reasons for forbearance included temporary hardships such as job loss, death, divorce, or disability (78%), natural disasters (12.6%), and COVID-19 (9.4%).

Read next: Three strategies to mitigate risk in real estate investing in 2024

By stage, 57.2% of total loans in forbearance were in the initial plan stage, 22.5% were in a forbearance extension, and 20.3% were forbearance re-entries, including those with extensions.

The five states with the highest share of loans that were current as a percent of the servicing portfolio were Washington, Colorado, Idaho, Oregon, and California. Conversely, the states with the lowest share were Louisiana, Mississippi, Indiana, Alabama, and New York.

The total number of completed loan workouts from 2020 onwards, including repayment plans, loan deferrals/partial claims, and loan modifications, saw a slight decrease in performance. The percentage of these workouts that were current dropped to 75.78% in May 2024, down from 75.86% in April.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.