MBA reports that jumbo mortgages drove the increase

.jpg)

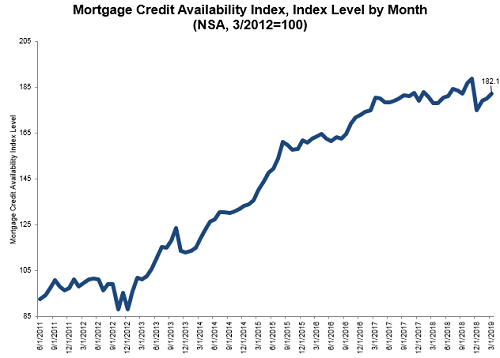

Mortgage credit availability increased in March compared to the previous month according to the Mortgage Bankers Association.

Its Mortgage Credit Availability Index (MCAI) increased 1.1% indicating a loosening of lending standards with the Conventional MCAI rising 3.6%, driven by the jumbo component (up 5.2%) while the conventional component was up 1.4%.

The Government MCAI declined 1.2%.

"Credit availability increased in March, primarily due to a spike in jumbo mortgage offerings. The jumbo sub-index increased 5% and reached its highest level since last November, as the recent decline in mortgage rates led to a jump in refinances from borrowers with larger loans," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "The credit supply for government loans decreased in March, as investors continue to reduce FHA and VA streamline refi offerings."

Source: Mortgage Bankers Association; Powered by Ellie Mae's AllRegs® Market Clarity®

The index was benchmarked to 100 in March 2012.