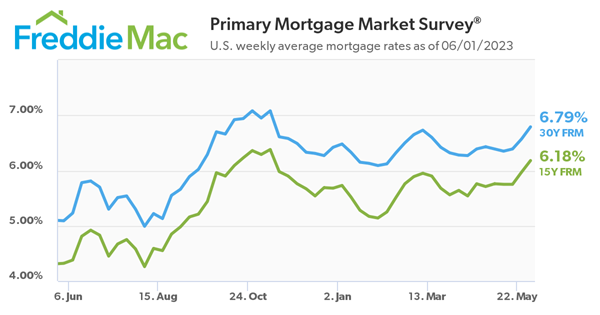

Long-term rates continue upward trend

US mortgage rates edged up this week, according to Freddie Mac, with the 30-year fixed-rate loan creeping closer to the 7% threshold.

The benchmark 30-year mortgage rate increased to 6.79%, up from last week’s 6.57%, Freddie Mac’s Primary Mortgage Market Survey showed. The 15-year fixed mortgage averaged 6.18%, a 21-basis-point jump from the previous week.

“Mortgage rates jumped this week, as a buoyant economy has prompted the market to price-in the likelihood of another Federal Reserve rate hike,” Freddie Mac chief economist Sam Khater said. “Although there has been a steady flow of purchase demand around rates in the low to mid 6% range, that demand is likely to weaken as rates approach 7%.”

According to the Mortgage Bankers Association, a higher contract interest rate for the 30-year loan has led to a 3.7% decline in the overall mortgage application volume. Refinance applications fell 7% week over week, and purchase activity dwindled 3%.

“Inflation is still running too high, and recent economic data is beginning to convince investors that the Federal Reserve will not be cutting rates anytime soon. Mortgage rates for conforming, balance 30-year loans were being quoted above 7% by some lenders last week, and the weekly average at 6.9% reached the highest level since last November,” said Mike Fratantoni, MBA’s chief economist.

See the current mortgage rates in the USA as well as the average and state by state breakdown.

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.