Home equity trends follow steady decline in home price growth

Annual home equity growth continued to cool as the decline in home prices persisted in the fourth quarter of 2022, CoreLogic reported Thursday.

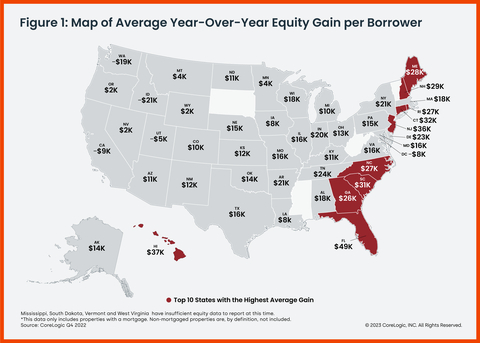

Homeowners saw their equity grow by 7.3% year over year, marking a collective gain of $1 trillion. The average mortgage borrower earned about $14,300 in equity, compared with the $63,100 increase in the first quarter of 2022.

"While equity gains contracted in late 2022 due to home price declines in some regions, U.S. homeowners on average still have about $270,000 in equity more than they had at the onset of the pandemic," said CoreLogic chief economist Selma Hepp.

CoreLogic's home price index slowed to a 5.5% annual rate in January – the lowest recorded since June 2020. CoreLogic estimates that 145,000 homes would regain equity if prices rose by 5%. However, if prices fall by 5%, 215,000 properties would fall underwater.

Negative equity, also known as underwater mortgages, increased 6% in Q4 to 1.2 million homes from the previous quarter but was down 2% year over year.

"Nevertheless, with 66,000 borrowers entering negative equity in the fourth quarter, the total number of underwater properties is now approaching levels seen at the end of 2021, which was the lowest since the Great Recession," Hepp said.

"The new hot spots for equity declines are largely markets that have seen the most significant home price deceleration, including Boise, Idaho; the San Francisco Bay Area; cities in Utah; Phoenix and Austin, Texas."

Want to make your inbox flourish with mortgage-focused news content? Get exclusive interviews, breaking news, industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.