Downtrend offers a sigh of relief in turbulent market

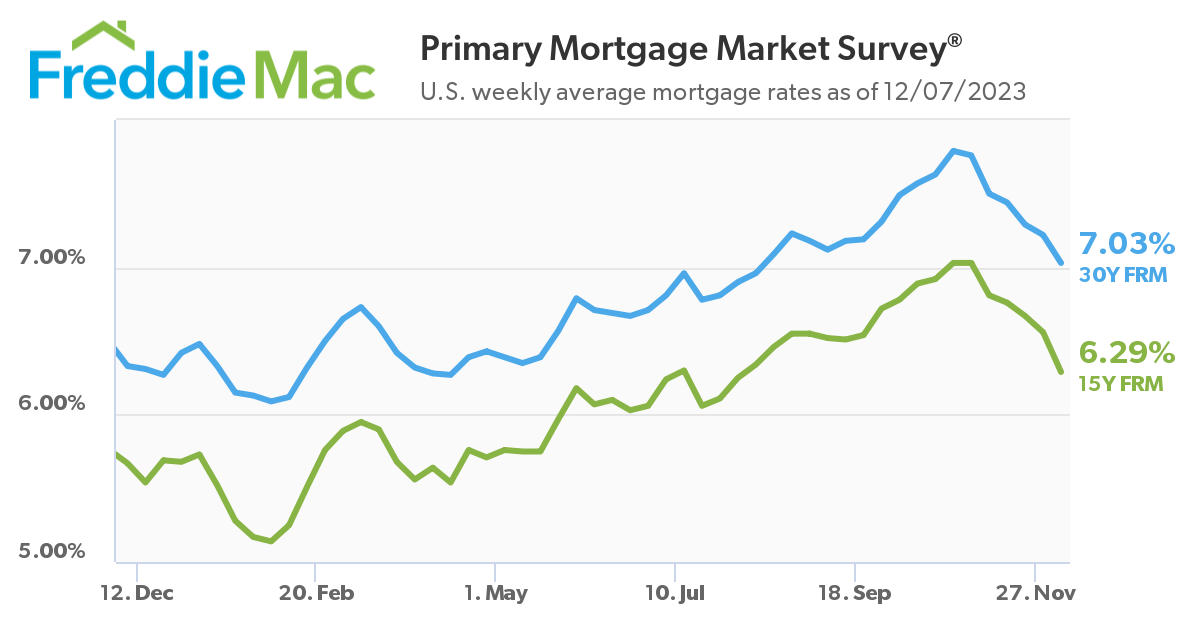

The 30-year fixed mortgage rate is close to returning to 7% levels as the US economy continues to slow, according to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS).

The PMMS report showed a 19 basis-point drop in the average 30-year fixed-rate mortgage (FRM). The 15-year FRM, which now stands at 6.29%, fell from 6.56% in the previous week. At this time last year, the average for the 30-year rate was 6.33%, and the 15-year FRM was 5.67%.

“The 30-year fixed-rate mortgage averaged near 7% this week, down from nearly 7.80% just six weeks ago,” said Freddie Mac chief economist Sam Khater. “When rates began to rapidly drop, purchase applications rebounded initially, but this improvement in demand diminished in the last week.”

Purchase apps dropped 0.3% on a seasonally adjusted basis and up 35% on an unadjusted basis. Meanwhile, applications for refis reached a record high last week, up 14% from the week before, according to the Mortgage Bankers Association.

“Although these lower rates remain a welcome relief, it is clear they will have to further drop to more consistently reinvigorate demand,” Khater added.

Read more: Mortgage origination satisfaction: How the industry is performing in tough times

“Slower inflation and financial markets anticipating the potential end of the Fed’s hiking cycle, are both behind the recent decline in rates,” commented Joel Kan, vice president and deputy chief economist at MBA.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.