"Homebuyers have adjusted"

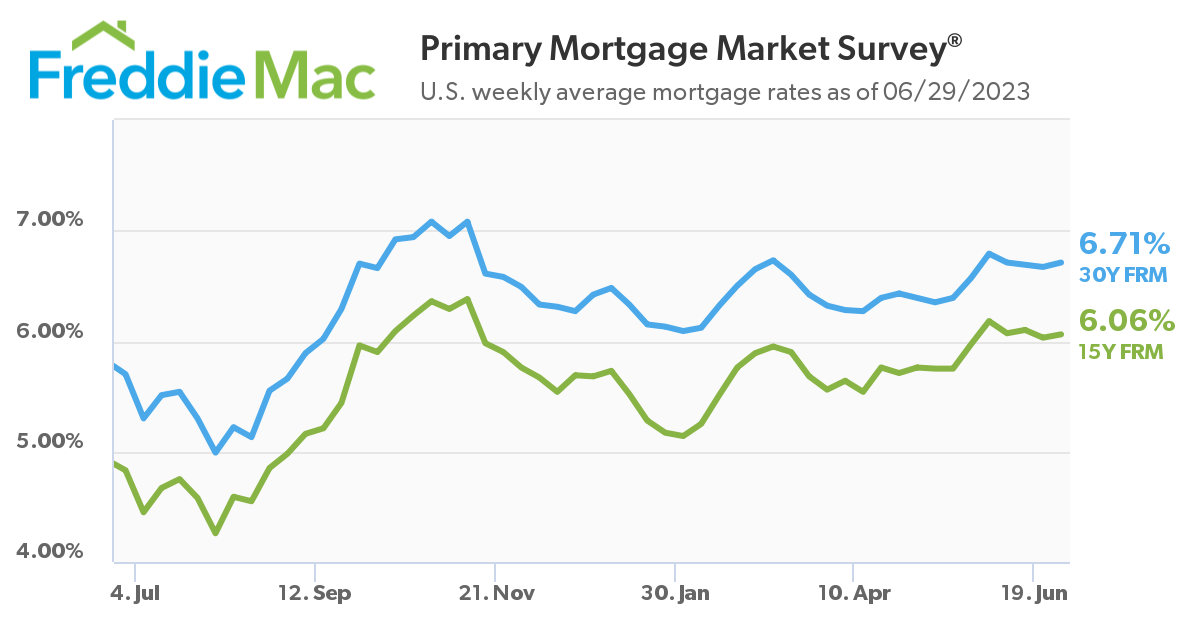

Freddie Mac has revealed its latest update on long-term mortgage rates, with the benchmark 30-year mortgage rate rising after three weeks of decline.

There was a four-basis-point uptick in the 30-year fixed-rate mortgage, which averaged 6.71% as of June 29. The 15-year loan rate inched up three basis points to 6.06% from last week.

“Mortgage rates have hovered in the 6-7% range for over six months and, despite affordability headwinds, homebuyers have adjusted and driven new home sales to its highest level in more than a year,” said Freddie Mac chief economist Sam Khater. “New home sales have rebounded more robustly than the resale market due to a marginally greater supply of new construction. The improved demand has led to a firming of prices, which have now increased for several months in a row.”

Mark Fleming, chief economist of First American Financial, believes prices have remained resilient because the relationship between rising mortgage rates and home prices may not be as straightforward as many think.

“Even as the Federal Reserve continues to fight inflation with restrictive monetary policy, which will keep upward pressure on mortgage rates, don’t expect house prices to decline dramatically,” Fleming said. “History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices.”

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.