Rates will retreat if the Fed provides investors with more certainty, says First American economist

Long-term mortgage rates rose this week as debt ceiling worries continued to weigh on the housing market.

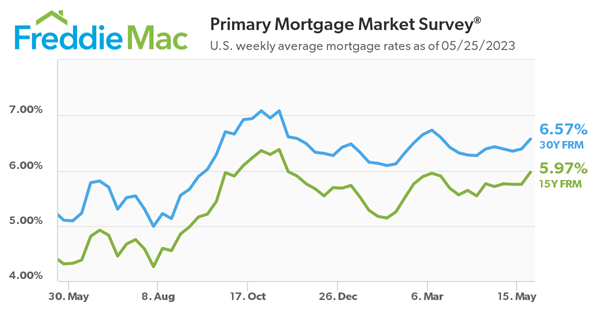

The 30-year fixed-rate mortgage jumped 18 basis points to 6.57% as of May 25, according to the results of Freddie Mac’s Primary Mortgage Market Survey. The rate for the fixed 15-year loan averaged 5.97%, up from 5.75% last week.

“The US economy is showing continued resilience which, combined with debt ceiling concerns, led to higher mortgage rates this week,” Freddie Mac chief economist Sam Khater said. “Dampened affordability remains an issue for interested homebuyers, and homeowners seem unwilling to lose their low rate and put their home on the market. If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage.”

First American deputy chief economist Odeta Kushi analyzed the spread between mortgage rates and the 10-Year Treasury Yield and how it might shift in the months ahead.

“Since the end of the Great Recession, the 30-year fixed mortgage rate has on average remained 1.7 percentage points (170 basis points) higher than the 10-year Treasury bond yield,” Kushi explained. “Yet, this spread is not always consistent. It usually widens during periods of economic or geopolitical uncertainty, as is the case in today’s market. Since the year 2000, there have been 59 months, approximately 21% of the time, when the average spread was at least 200 basis points.”

Kushi noted that there’s a possibility that the spread could narrow but may not return to historical norms.

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty,” she added. “However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.