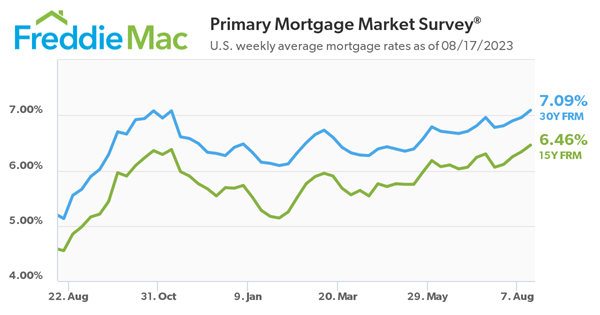

The 30-year rate crosses the 7% threshold again

The average 30-year mortgage rate has surged past 7% this week, marking its highest level in over two decades, Freddie Mac reported Thursday.

The long-term fixed mortgage rate now stands at 7.09%, up from last week's 6.96% and a substantial rise from 5.13% recorded a year ago. Meanwhile, the 15-year fixed-rate mortgage averaged 6.46%, up from 6.34% a week ago.

The last time the 30-year rate exceeded 7% was last November, Freddie Mac chief economist Sam Khater noted. "The economy continues to do better than expected, and the 10-year Treasury yield has moved up, causing mortgage rates to climb," he said in a news release.

Khater went on to explain that while affordability challenges have influenced demand, low inventory remained the root cause of stalling the sales of both new and existing homes.

New home sales dropped 2.5% to an annualized rate of 697,000 in June, while existing-home transactions fell 3.3% to a 4.16 million pace.

"The new reality has jolted the housing market: Home sales have fallen sharply since 2021, and homeowners, reluctant to give up their super-low mortgage rates, are staying put," Bankrate analyst Jeff Ostrowski said. "Housing affordability has emerged as a persistent challenge.

"High rates are challenging for homebuyers, but it's worth noting that Americans bought homes before the recent era of super-low rates. In one oft-cited example, mortgage rates went as high as 18% in the early 1980s, and buyers still found ways to get deals done. Not that it's easy to buy when rates are at generational highs."

Want to keep up with the latest mortgage news? Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.