Rate increases hinder affordability gains made earlier this fall

Mortgage rates, which have fluctuated since the election as markets assess their economic impact, edged higher this week.

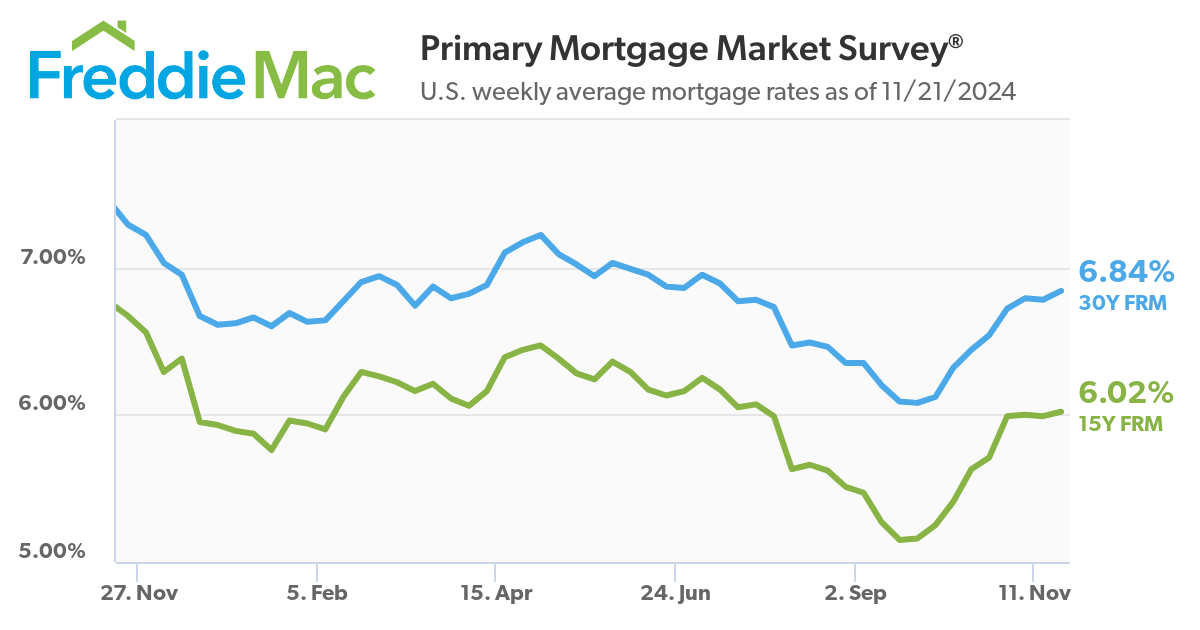

Freddie Mac’s latest survey showed the 30-year fixed-rate mortgage (FRM) averaging 6.84% as of November 21, up from 6.78% the previous week. The 15-year FRM also saw a slight increase, averaging 6.02%, compared to 5.99% the previous week.

Both rates, however, remained below the levels seen a year ago when the 30-year FRM averaged 7.29% and the 15-year FRM stood at 6.67%.

“Mortgage rates ticked back up this week, continuing to approach 7%,” Freddie Mac chief economist Sam Khater said in the report. “Heading into the holidays, purchase demand remains in the doldrums. While for-sale inventory is increasing modestly, the elevated interest rate environment has caused new construction to soften.”

Sales boost

Holden Lewis, home and mortgage expert at NerdWallet, said “the overall rate trend seems to be upward, because inflation hasn't been fully tamed yet.”

Lewis noted that home sales surged in October because mortgage rates plunged below 6.25% in September. When rates dropped, buyers acted quickly — making successful offers in September and closing in October.

Existing-home sales increased by 2.9% year-over-year in October, the first annual rise in over three years, the National Association of Realtors (NAR) reported Thursday. Sales also grew 3.4% compared to September, reaching a seasonally adjusted annual rate of 3.96 million.

The median existing-home sales prices climbed for the 16th consecutive month, up 4% year over year to $407,200. Meanwhile, national inventory increased 0.7% from September to 1.37 million – the equivalent of 4.2 months of supply.

“We saw an uncharacteristic price increase in October as a result of those buyers pouring into the market after mortgage rates fell,” Holden said. “Even with the rise in purchases, the inventory of homes for sale increased, too. That means buyers have more properties to choose from.”

Short-lived relief

Still, the short-lived mortgage rate relief in September provided a brief window of improved affordability.

A Zillow analysis revealed that a middle-income household could afford 27.7% of homes on the market during that time — the highest share since February 2023. By comparison, in May, when rates averaged 7.06%, that number was just 22.7%.

"Affordability remains the top challenge for first-time home buyers especially, and buying power can change quickly with the unpredictable nature of mortgage rates," said Orphe Divounguy, a senior economist for Zillow Home Loans.

Read next: Outdated tactics holding you back? Why cold-calling realtors and door-knocking needs to go

As rates climbed back to 6.84% in November, the affordability gains made earlier in the fall have started to erode, pushing some prospective buyers back to the sidelines.

"Buyers should expect more ups and downs ahead for mortgage rates. While there's no guarantee, signs point to rates moving a bit lower into next year. However, the path will be bumpy, and buyers should stay ready to move forward when the time is right for them," Divounguy said.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.