Analysis shows some markets are above their previous bubble levels

The challenge of affording to buy a home in the US have never been greater with prices outpacing incomes and some markets requiring homebuyers with six-figure incomes.

An analysis of the 50 largest US metro markets over the past 20 years by blockchain-powered real estate marketplace PropertyClub, shows that the salary needed to buy a single-family home is $48,150; and for a 1-bedroom apartment it’s $36,578.

During the last housing bubble of 2007-2008, the peak income requirements were $41,914 for a single-family home and $35,357 for a 1-bedroom apartment.

Source: PropertyClub Inc.

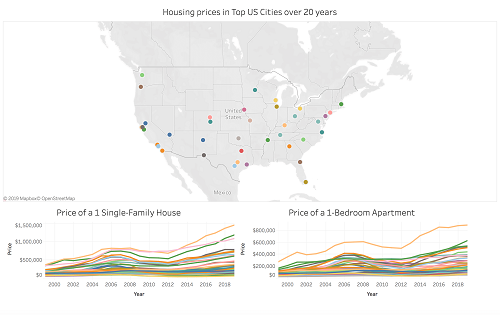

The west coast continues to be the region where home prices have been rising sharply, led by San Francisco and Los Angeles.

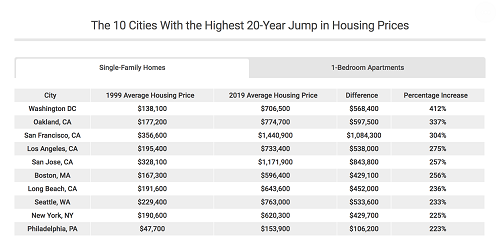

Between 1999 and 2019, single-family homes in San Francisco and Los Angeles have seen price increases of 304% and 275% respectively while single-family homes in Oakland have seen an increase of 337%.

Source: PropertyClub Inc.

Washington, DC leads the nation with a 412% rise over the past 20 years while New York City has seen a 225% increase.

Cleveland is the only city where single-family home prices are lower today than they were 20 years ago. It would only take approximately three years of savings to purchase a single-family home in the city.

.png)

Source: PropertyClub Inc.