One type of debt is drawing comparisons to the subprime loans that contributed to the economic downturn, and default rates are even higher

A recently released study is comparing student loans from for-profit universities to the subprime mortgage loans that had a disastrous impact on the American economy.

“A poor performing for-profit college looks and smells a lot like a subprime mortgage originator. They get all the profits but had no skin in the game when things went sour,” Rohit Chopra, former student loan ombudsman at the Consumer Financial Protection Bureau told MarketWatch.

The study, written by Federal Reserve Board Advisor Karen Pence, looks at the skyrocketing default levels of those who have taken out student loans at for-profit schools.

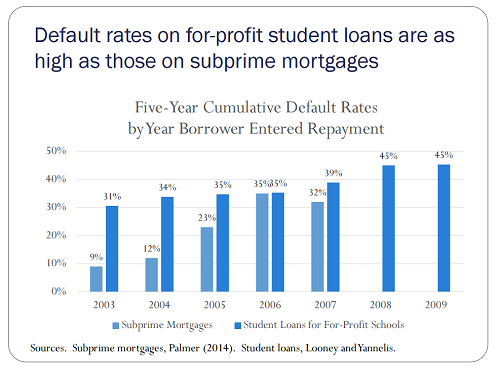

According to the study, these student loans averaged a 38% default rate from 2003-2009.

Subprime mortgages leading up to the financial crisis, meanwhile, averaged a 22.2% default rate.

Despite the fact that these loans often have smaller balances than subprime mortgages, they could actually have a greater negative impact on individuals, Pence argues, since the Department of Education often recovers the funds through social security and tax refund checks.

So while Americans had the ability to sell their homes in the event of a mortgage default, they are often left with fewer options to help them pay down growing student debt.

Still that debt, whether in or out of arrears, isn’t going away, nor is it being forgiven.

The Department of Education has “extraordinary collection powers,” Pence writes, noting it recovers 80-100% of defaulted principal interest.