Broader financing options incentivize homebuying for veterans and active-duty service members, according to new data

.jpg)

For originators looking to expand their toolbox, VA loans might be the way to go. Broader financing options incentivize homebuying for veterans and active military members, according to new data from the National Association of Realtors.

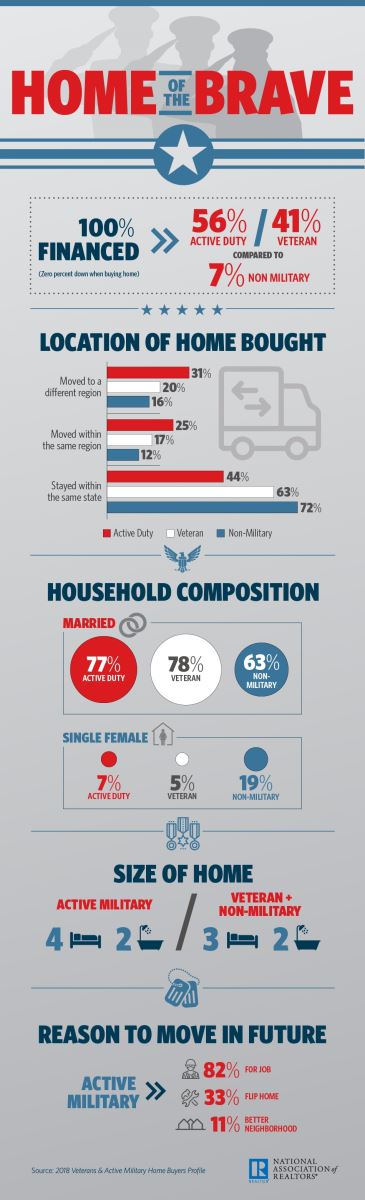

The NAR’s 2018 Veterans & Active Military Home Buyers Profile revealed several contrasts between military members and buyers who never served. The typical active-duty buyer’s median age was 34 – much younger than the median age of non-military buyers, 42. Active-duty service members were also more likely to be married and have multiple children living at home. They also typically buy larger homes than both non-military homebuyers and veterans, according to the report.

Military members have a lower median income than non-military buyers, but more job security and better financing options give them an advantage, according to the NAR. Fifty-six percent of active-duty buyers and 41% of veterans put no money down when buying a home, while only 7% of non-military buyers did. And the vast majority of active-duty buyers (77%) and more than half of veterans (56%) used a VA loan to purchase their homes.

Military members are also likely to be in the market for a home; 82% will move for their job. Just 34% of veterans and 58% of non-military buyers, meanwhile, said they would move for their jobs.

Source: National Association of Realtors

Related stories:

Company makes construction-to-permanent loans available for military families

Only a fraction of veterans take advantage of VA loans