Chicago saw the biggest decline in composite rate

Consumer credit defaults saw a downshift in April, with three of the five metros posting month-over-month declines in default rates.

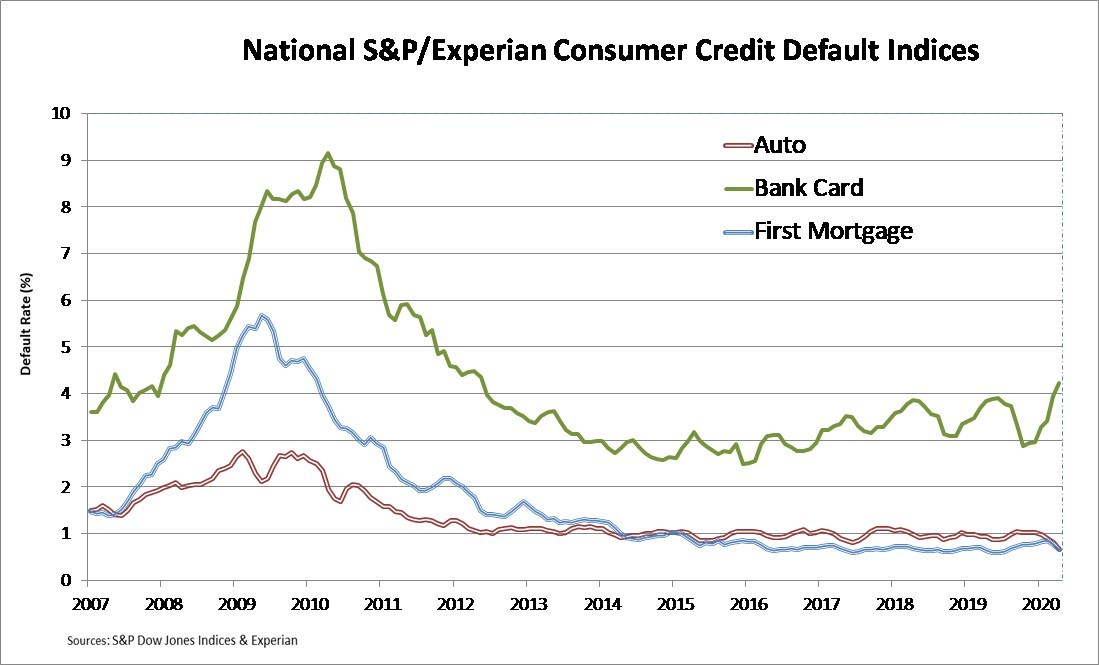

The latest S&P/Experian Consumer Credit Default Indices showed that the composite rate edged down nine basis points to 0.9%. Both first-mortgage default and auto-loan default rates fell to 0.66% in April, down 11 basis points and 15 basis points, respectively. Meanwhile, the bank-card default rate showed a 29-basis-point gain, up to 4.23%.

Of the five major metropolitan statistical areas, three experienced lower default rates compared to the previous month.

Chicago reported the largest drop, down 15 basis points to 1.06%. Coronavirus hard-hit metros Dallas (-13 basis points to 0.88%) and New York (-4 basis points to 0.95%) followed. Meanwhile, rates increased in Miami (+13 basis points to 1.54%) and Los Angeles (+3 basis points to 0.74%).