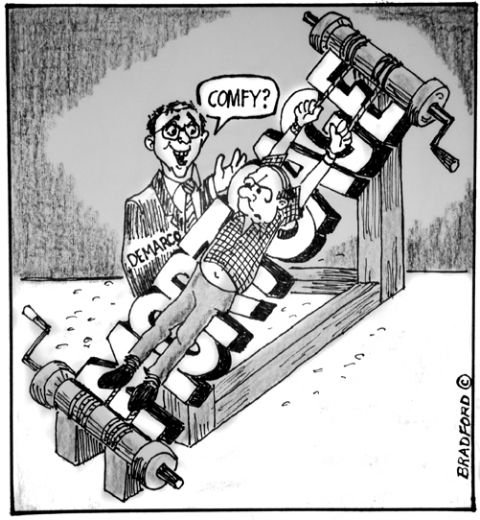

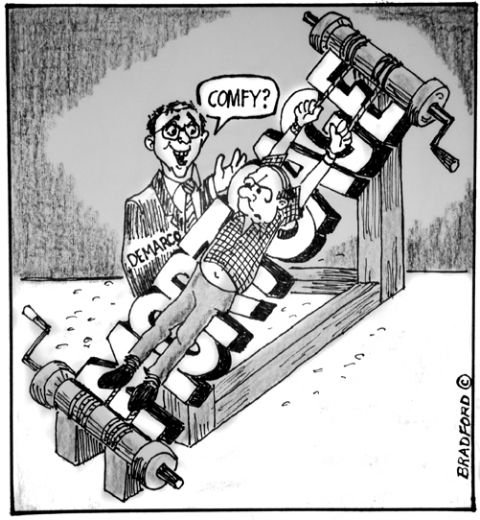

[caption id="attachment_8985" align="alignleft" width="480" caption="Cartoon from The Niche Report Magazine"] [/caption] (Bloomberg) -- A new analysis shows allowing Fannie Mae and Freddie Mac to forgive a portion of a troubled borrower's outstanding home loan may actually save the mortgage giants $1.7 billion. That still may not be enough to convince Federal Housing Finance Agency Acting Director Edward DeMarco, who oversees Fannie and Freddie, to move forward with such a program. In a speech today at The Brookings Institution, DeMarco offered several reasons he may not allow Fannie and Freddie to proceed with so-called principal forgiveness, including that it might encourage borrowers to strategically default on their loans. “Will some percentage of borrowers who are current on their loans be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal reduction?” DeMarco asked in his speech. It's no secret DeMarco is not keen on the idea. He has said time and again he believes other foreclosure mitigation tools are effective and will cost the mortgage giants less. But the new analysis chips away at that argument. It incorporates new incentives being offered by the U.S. Treasury Department to pay Fannie and Freddie as much as 63 cents for every dollar of principal they forgive. That tips the economic balance in favor of principal forgiveness, versus principal forbearance (in which a portion of the outstanding balance is deferred until the homeowner can make good on the total amount). Still, DeMarco appears unconvinced. He says fewer than 1 million households would be eligible and that savings from the forgiveness could be offset by the cost of implementing the program. “All these cost factors would have to be carefully considered in coming to a decision on whether to employ principal forgiveness or not,” he said. Ironically, he agrees that forgiving a portion of a borrower's outstanding loan balance makes a person less likely to default. But he is putting the bottom lines of Fannie and Freddie ahead of troubled borrowers and the broader housing market, which is at risk of a foreclosure death spiral. "Borrowers receiving principal forgiveness default less often than those who receive principal forbearance," DeMarco said today. However, he continues, "the losses associated with the principal forgiveness write-offs more than offset the savings from lower re-default rates." Read full story from Bloomberg

[/caption] (Bloomberg) -- A new analysis shows allowing Fannie Mae and Freddie Mac to forgive a portion of a troubled borrower's outstanding home loan may actually save the mortgage giants $1.7 billion. That still may not be enough to convince Federal Housing Finance Agency Acting Director Edward DeMarco, who oversees Fannie and Freddie, to move forward with such a program. In a speech today at The Brookings Institution, DeMarco offered several reasons he may not allow Fannie and Freddie to proceed with so-called principal forgiveness, including that it might encourage borrowers to strategically default on their loans. “Will some percentage of borrowers who are current on their loans be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal reduction?” DeMarco asked in his speech. It's no secret DeMarco is not keen on the idea. He has said time and again he believes other foreclosure mitigation tools are effective and will cost the mortgage giants less. But the new analysis chips away at that argument. It incorporates new incentives being offered by the U.S. Treasury Department to pay Fannie and Freddie as much as 63 cents for every dollar of principal they forgive. That tips the economic balance in favor of principal forgiveness, versus principal forbearance (in which a portion of the outstanding balance is deferred until the homeowner can make good on the total amount). Still, DeMarco appears unconvinced. He says fewer than 1 million households would be eligible and that savings from the forgiveness could be offset by the cost of implementing the program. “All these cost factors would have to be carefully considered in coming to a decision on whether to employ principal forgiveness or not,” he said. Ironically, he agrees that forgiving a portion of a borrower's outstanding loan balance makes a person less likely to default. But he is putting the bottom lines of Fannie and Freddie ahead of troubled borrowers and the broader housing market, which is at risk of a foreclosure death spiral. "Borrowers receiving principal forgiveness default less often than those who receive principal forbearance," DeMarco said today. However, he continues, "the losses associated with the principal forgiveness write-offs more than offset the savings from lower re-default rates." Read full story from Bloomberg

[/caption] (Bloomberg) -- A new analysis shows allowing Fannie Mae and Freddie Mac to forgive a portion of a troubled borrower's outstanding home loan may actually save the mortgage giants $1.7 billion. That still may not be enough to convince Federal Housing Finance Agency Acting Director Edward DeMarco, who oversees Fannie and Freddie, to move forward with such a program. In a speech today at The Brookings Institution, DeMarco offered several reasons he may not allow Fannie and Freddie to proceed with so-called principal forgiveness, including that it might encourage borrowers to strategically default on their loans. “Will some percentage of borrowers who are current on their loans be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal reduction?” DeMarco asked in his speech. It's no secret DeMarco is not keen on the idea. He has said time and again he believes other foreclosure mitigation tools are effective and will cost the mortgage giants less. But the new analysis chips away at that argument. It incorporates new incentives being offered by the U.S. Treasury Department to pay Fannie and Freddie as much as 63 cents for every dollar of principal they forgive. That tips the economic balance in favor of principal forgiveness, versus principal forbearance (in which a portion of the outstanding balance is deferred until the homeowner can make good on the total amount). Still, DeMarco appears unconvinced. He says fewer than 1 million households would be eligible and that savings from the forgiveness could be offset by the cost of implementing the program. “All these cost factors would have to be carefully considered in coming to a decision on whether to employ principal forgiveness or not,” he said. Ironically, he agrees that forgiving a portion of a borrower's outstanding loan balance makes a person less likely to default. But he is putting the bottom lines of Fannie and Freddie ahead of troubled borrowers and the broader housing market, which is at risk of a foreclosure death spiral. "Borrowers receiving principal forgiveness default less often than those who receive principal forbearance," DeMarco said today. However, he continues, "the losses associated with the principal forgiveness write-offs more than offset the savings from lower re-default rates." Read full story from Bloomberg

[/caption] (Bloomberg) -- A new analysis shows allowing Fannie Mae and Freddie Mac to forgive a portion of a troubled borrower's outstanding home loan may actually save the mortgage giants $1.7 billion. That still may not be enough to convince Federal Housing Finance Agency Acting Director Edward DeMarco, who oversees Fannie and Freddie, to move forward with such a program. In a speech today at The Brookings Institution, DeMarco offered several reasons he may not allow Fannie and Freddie to proceed with so-called principal forgiveness, including that it might encourage borrowers to strategically default on their loans. “Will some percentage of borrowers who are current on their loans be encouraged to either claim a hardship or actually go delinquent to capture the benefits of principal reduction?” DeMarco asked in his speech. It's no secret DeMarco is not keen on the idea. He has said time and again he believes other foreclosure mitigation tools are effective and will cost the mortgage giants less. But the new analysis chips away at that argument. It incorporates new incentives being offered by the U.S. Treasury Department to pay Fannie and Freddie as much as 63 cents for every dollar of principal they forgive. That tips the economic balance in favor of principal forgiveness, versus principal forbearance (in which a portion of the outstanding balance is deferred until the homeowner can make good on the total amount). Still, DeMarco appears unconvinced. He says fewer than 1 million households would be eligible and that savings from the forgiveness could be offset by the cost of implementing the program. “All these cost factors would have to be carefully considered in coming to a decision on whether to employ principal forgiveness or not,” he said. Ironically, he agrees that forgiving a portion of a borrower's outstanding loan balance makes a person less likely to default. But he is putting the bottom lines of Fannie and Freddie ahead of troubled borrowers and the broader housing market, which is at risk of a foreclosure death spiral. "Borrowers receiving principal forgiveness default less often than those who receive principal forbearance," DeMarco said today. However, he continues, "the losses associated with the principal forgiveness write-offs more than offset the savings from lower re-default rates." Read full story from Bloomberg