Recently released data points to just how much the American housing market has rebounded from the disastrous collapse

Recently released data points to just how much the American housing market has rebounded from the disastrous collapse.

Foreclosures saw a 2.4% drop from November to December of last year, which represented 50 months of consecutive year-over-year declines.

“Reflecting on the full-year foreclosure results for 2015, we can see that completed foreclosures are down more than 20 percent for the year, which is the lowest level since 2006, before the crisis,” Frank Nothaft, chief economist at CoreLogic, said in the report. “Maryland, which can be described as a suburb of the solid D.C. market, led the way with a 59-percent decline in foreclosures in 2015.”

According to CoreLogic’s National Foreclosure Report for December, there were 32,000 completed foreclosures across the country, which was down from 41,000 the month prior.

The number seriously delinquent rate fell to 3.2%, which was the lowest level since 2007.

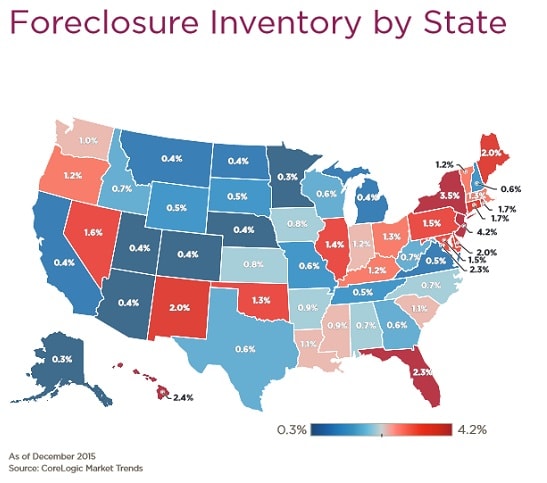

In total, there were around 433,000 U.S. home in some stage of foreclosure. That was down from 568,000 in December 2014.

Dropping delinquency levels speak to the fact that lenders have tightened their lending standards in the wake of the financial crisis. That more prudent lending is obviously having an impact.

“The supply of distressed inventory continues to shrink rapidly. While this is positive for the housing market overall, it also drives a decline in the inventory of affordable for-sale homes,” Anand Nallathambi, president and CEO of CoreLogic, said. “The lack of housing stock, particularly affordable inventory, is a growing issue and will limit a full housing recovery in the short to medium term.”