It's hard to think of a bright side to the American housing bubble. Many economists and analysts agree that the bursting of the bubble was a major contributing factor to the global financial crisis, which in turn snowballed into an economic avalanche of foreclosures, bank failures, unemployment, and a deep loss of confidence among consumers.

High Home Affordability Makes it Cheaper to Buy than Rent

It's hard to think of a bright side to the American housing bubble. Many economists and analysts agree that the bursting of the bubble was a major contributing factor to the global financial crisis, which in turn snowballed into an economic avalanche of foreclosures, bank failures, unemployment, and a deep loss of confidence among consumers. After years of negativity, a bit of solace has materialized in a report from the U.S. Department of Housing and Urban Development (HUD) indicates that home affordability is currently the highest it has been since 1971.

Home affordability is essentially a ratio that assumes house buyers will put 20 percent down towards purchase and and spend no more than 25 percent of their monthly household income to cover all expenses related to housing. This is also known as the housing expense-to-income ratio. The reason why home affordability is now looking better than it did even during the freewheeling first decade of the 21st century is a combination of two key factors. Market prices have receded to levels last seen in 2003, and mortgage interest rates are at historical lows.

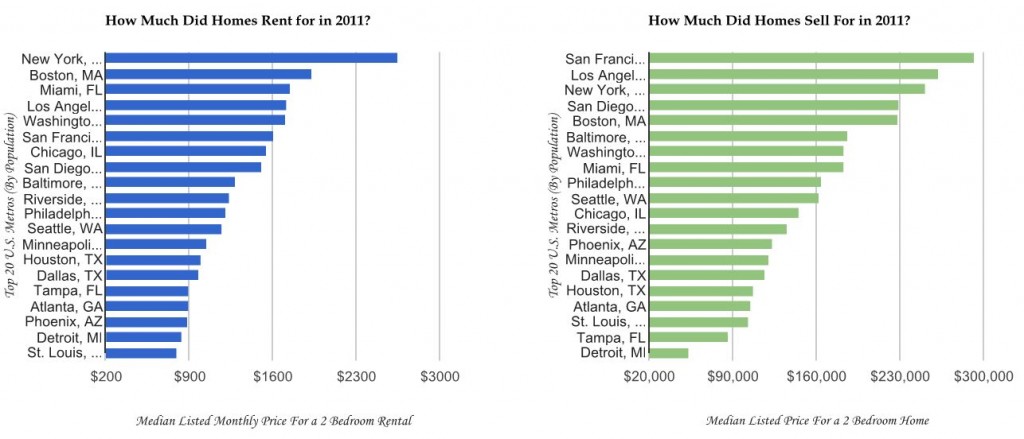

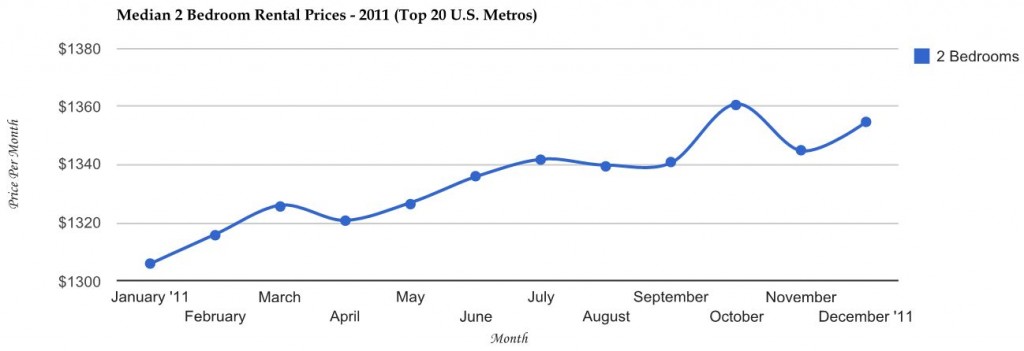

As home purchases become more affordable, the rental market keeps heating up. The average monthly payment on a leased two-bedroom home in the top U.S. metropolitan areas is currently about $1,350. That's an increase of 3.75 percent year in 2011, compared to a 1.83 drop of home median prices in the same metro areas. The reason behind the increment in monthly rental payments can be attributed to homeowners exiting their purchased homes, either due to short-sales, deep negative appreciation and foreclosures. The stubborn unemployment rate has shown some signs of relief, and the employers taking on more new hires are located in many of the top metro areas. Rents are expected to edge up a little higher, but not at the rapid pace of 2011.

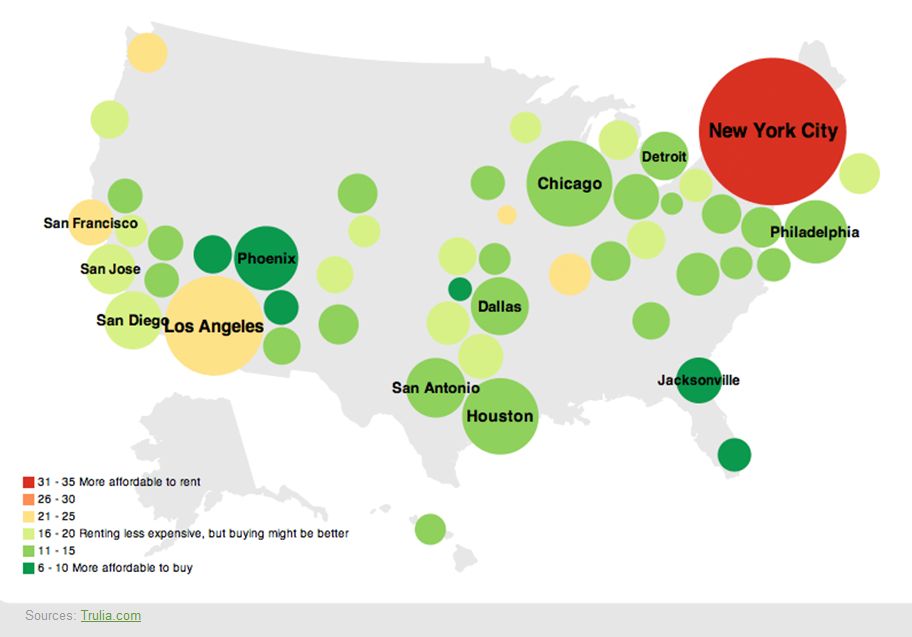

With home affordability at an all-time high and lease contracts expected to inch up in 2012, it is safe to assume that the endless debate over whether it is cheaper to buy than to rent is currently in favor of buying, at least in cities such as Atlanta, Chicago, Detroit, Houston, Miami, and New York. On the other hand, it is still cheaper to rent in San Francisco and Los Angeles, at least for now.

Home shoppers have on more advantage over renters. The current inventory of homes in the process of foreclosure makes it more likely for house hunters to find listings priced even lower than the already low median prices. This gives real estate shoppers the option of finding great deals on the short-sale listings or judicial foreclosure auctions.