National HPI data suggests slower growth is not just in the west

(2).jpg)

Home prices continue to cool nationally with double-digit gains on hold for now.

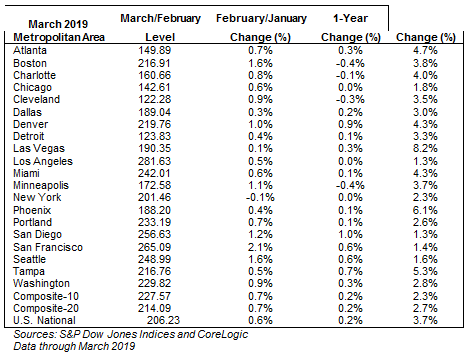

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census divisions, reported a 3.7% annual gain in March, down from 3.9% in the previous month.

Meanwhile, there were smaller gains than in the previous month for the 10-City Composite (2.3% year-over-year, down from 2.5); and the 20-City Composite (2.7% year-over-year, down from 3.0%).

“The U.S. housing market moderation has now lasted a year, driven by considerable slowing in the nation’s most expensive markets,” noted Dr. Ralph B. McLaughlin, deputy chief economist and executive of research and insights for CoreLogic.

He added that although these markets show the most pronounced slowdown, all of the 20-City markets are also slowing, “suggesting the cooldown has broken from its confines in the West.”

But he said there should be better times ahead.

“With the 10-year treasury falling, we can expect mortgage rates to continue to decline this spring. This should help to take the cold edge off what has otherwise been a market slow to thaw from the winter months,” said Dr McLaughlin.

These cities have the highest price growth

Las Vegas, Phoenix and Tampa reported the highest year-over-year gains among the 20 cities. In March, Las Vegas led the way with an 8.2% year-over-year price increase, followed by Phoenix with a 6.1% increase, and Tampa with a 5.3% increase.

But the growth in home prices in these markets is a far cry from the large hikes seen a year ago.

"The patterns seen in the last year or more continue: year-over-year price gains in most cities are consistently shrinking. Double-digit annual gains have vanished,” said David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “One year ago, Seattle had a 13% gain. In this report, Seattle prices are up only 1.6%.”

And Blitzer says the US housing market should be doing much better given the economic conditions, including low unemployment and moderate income rises; together with well-performing household debt and lower mortgage rates.

“The difficulty facing housing may be too-high price increases,” he said. “At the currently lower pace of home price increases, prices are rising almost twice as fast as inflation: in the last 12 months, the S&P Corelogic Case-Shiller National Index is up 3.7%, double the 1.9% inflation rate. Measured in real, inflation-adjusted terms, home prices today are rising at a 1.8% annual rate. This compares to a 1.2% real annual price increases in housing since 1975."