[/caption]

[/caption]

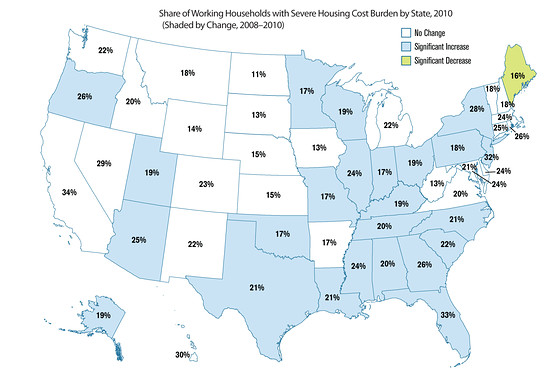

(Wallstreet Journal) 2/24/2012 - Though home prices have fallen dramatically as a result of the housing bust, paying the monthly cost of owning or renting a home hasn’t become any easier for many middle-income Americans families, a new study finds.

The study released Friday by the Washington-based Center for Housing Policy calculates the burden of housing costs for homeowners and renters with incomes of up to 120% of the median in their area by analyzing U.S. Census data.

Nearly 24% of those 45 million households spent more than half of their incomes on housing (including utilities) in 2010, up from about 23% in 2009 and 22% in 2008, the study finds. (It remains to be seen whether this trend will continue given the improving economic climate over the past six months.)

“Despite the fact that we’re seeing declining home prices across the country, housing isn’t becoming more affordable,” said Laura Williams, the study’s author and a research associate at the policy organization. The report noted that in 19 of the 50 largest U.S. metro areas the number of households with high housing cost burdens actually increased between 2008 and 2010.

Why? There are several reasons. Due to the rough economy, incomes for many families have fallen. The median household income of renters analyzed in the report fell to $30,229 in 2010 from $31,570 in 2008. For homeowners, the median household income fell to $41,413 in 2010 from $43,971 in 2008.

Meanwhile, rents have been rising. Plus, many homeowners haven’t been able to take advantage of record-low mortgage rates by refinancing their mortgages. That’s because they are “under water” – meaning that they owe more on their properties than the value of their homes.

The metro area with the largest share of households paying more than half of their income on housing was Miami, where 43% of households did so. It was followed by Los Angeles (38%), San Diego (37%), Riverside, Calif., (34%) and New York (34%).

The cities with the smallest share of households with a severe cost burden were Pittsburgh (15%), Buffalo (16%), San Antonio (17%), Rochester (17%) and Kansas City (17%).

Read the full report.